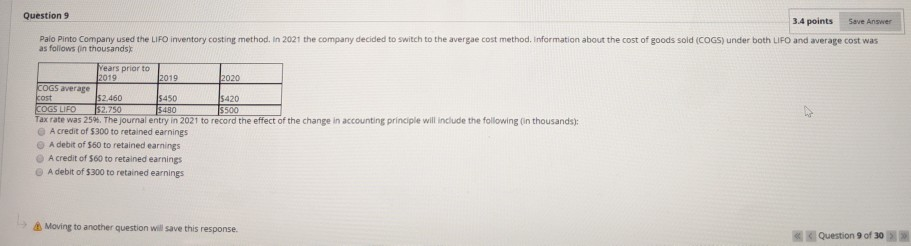

Question: Question 9 3.4 points Save Answer Palo Pinto Company used the LIFO inventory costing method. In 2021 the company decided to switch to the avergae

Question 9 3.4 points Save Answer Palo Pinto Company used the LIFO inventory costing method. In 2021 the company decided to switch to the avergae cost method. Information about the cost of goods sold (COGS) under both LIFO and average cost was as follows in thousands Years prior to 2019 2019 12020 COGS average cost 52,460 $450 5420 COGS LIFO 152.750 15480 $500 Tax rate was 25%. The journal entry in 2021 to record the effect of the change in accounting principle will include the following (in thousands): A credit of $300 to retained earnings A debit of 560 to retained earnings A credit of $60 to retained earnings A debit of $300 to retained earnings Moving to another question will save this response. Question 9 of 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts