Question: Question 9 4 pts In class we discussed the payback period method and how it should be used as an initial screen or a supplemental

Question

pts

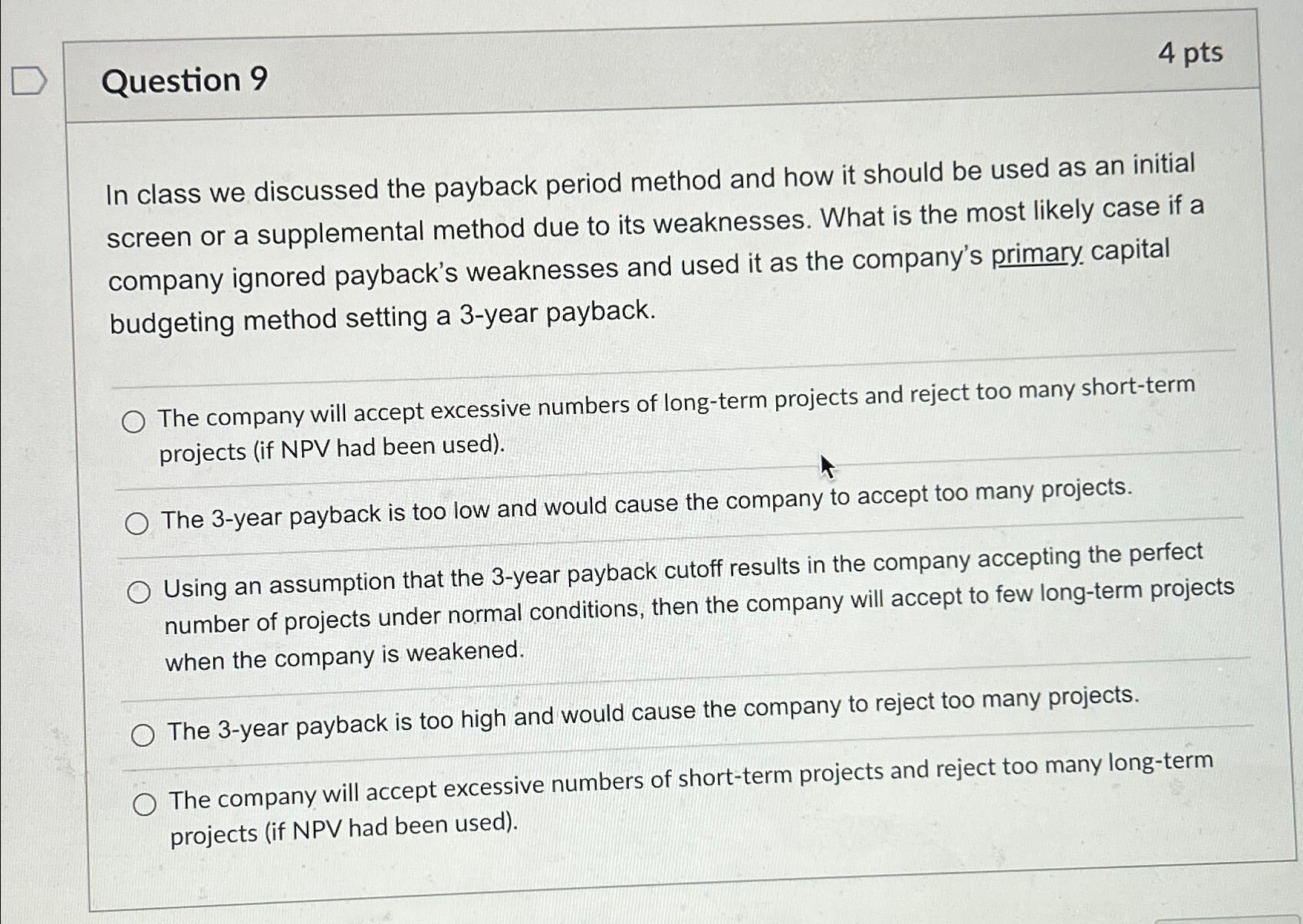

In class we discussed the payback period method and how it should be used as an initial screen or a supplemental method due to its weaknesses. What is the most likely case if a company ignored payback's weaknesses and used it as the company's primary capital budgeting method setting a year payback.

The company will accept excessive numbers of longterm projects and reject too many shortterm projects if NPV had been used

The year payback is too low and would cause the company to accept too many projects.

Using an assumption that the year payback cutoff results in the company accepting the perfect number of projects under normal conditions, then the company will accept to few longterm projects when the company is weakened.

The year payback is too high and would cause the company to reject too many projects.

The company will accept excessive numbers of shortterm projects and reject too many longterm projects if NPV had been used

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock