Question: QUESTION 9 A developer is considering developing a project based not he following assumptions: Year one estimate of net operating income: 5120,000 Market cap rate:

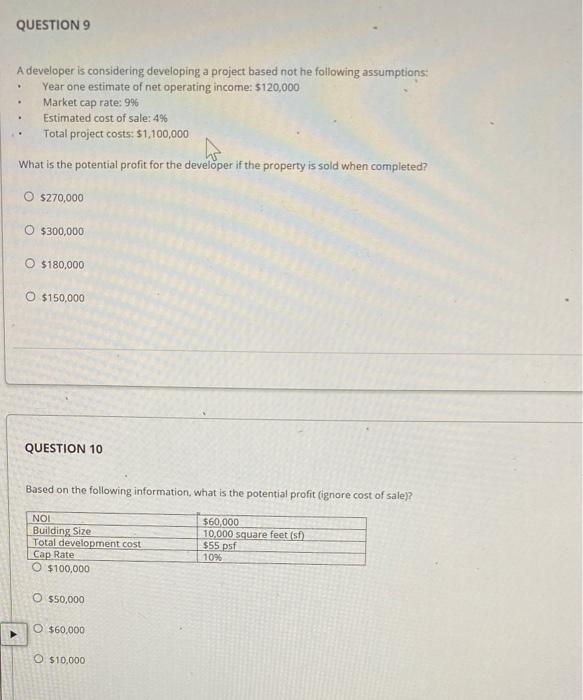

QUESTION 9 A developer is considering developing a project based not he following assumptions: Year one estimate of net operating income: 5120,000 Market cap rate: 996 Estimated cost of sale: 4% Total project costs: $1,100,000 What is the potential profit for the developer if the property is sold when completed? O $270,000 O $300,000 O $180,000 O $150,000 QUESTION 10 Based on the following information, what is the potential profit (ignore cost of sale)? NOI Building Size Total development cost Cap Rate O $100,000 $60,000 10,000 square feet (sf) $55 psf 1098 O $50,000 O $60.000 $10.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts