Question: Question 9: Anderson Systems is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that if

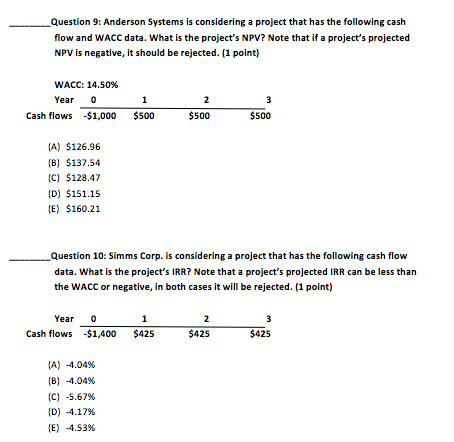

Question 9: Anderson Systems is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that if a project's projected NPV is negative, it should be rejected. (1 point) WACC: 14.50% Year 0 Cash flows -$1,000 $500 $500 $500 (A) $126.96 (B) $137.54 (C) $128.47 (D) $151.15 (E) $160.21 Question 10: Simms Corp. is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's projected IRR can be less than the WACC or negative, in both cases it will be rejected. (1 point) Year 0 Cash flows -1,400 $425 $425 $425 (A) -4.04% (B) -4.04% (C) -5.67% D) -4.17% (E) -4.53%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts