Question: Question 9 In an initial public offering ( IPO ) , an option that allows the underwriter to issue more stock, usually amounting to 1

Question

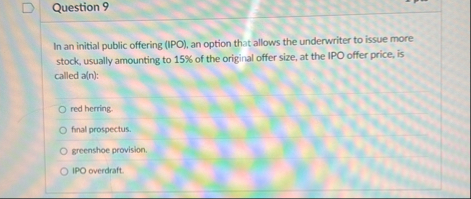

In an initial public offering IPO an option that allows the underwriter to issue more stock, usually amounting to of the original offer size, at the IPO offer price, is called an:

red herring.

Tinat prospectus.

greenshoe provision.

overdraft.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock