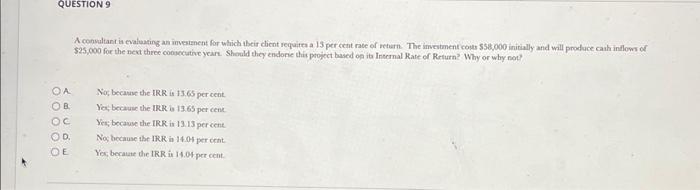

Question: QUESTION 9 OA. OB. 0000 O C. D. E. A consultant is evaluating an investment for which their client requires a 13 per cent rate

A. Nor becative the IRR is 13.65 per cent. B. Yos, because the IRR a 13.65 per cene C. Yes;bocause the IRR is 13.13 per eent D. Noc because the IRK is 14.04 per cent. E. Yec, beratate the IRR is is.04 per cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts