Question: Question 9 Partially correct Mark 7 . 6 9 out of 1 0 . 0 0 Flag question Consolidated Cash from Operations Consider the following

Question

Partially correct

Mark out of

Flag question

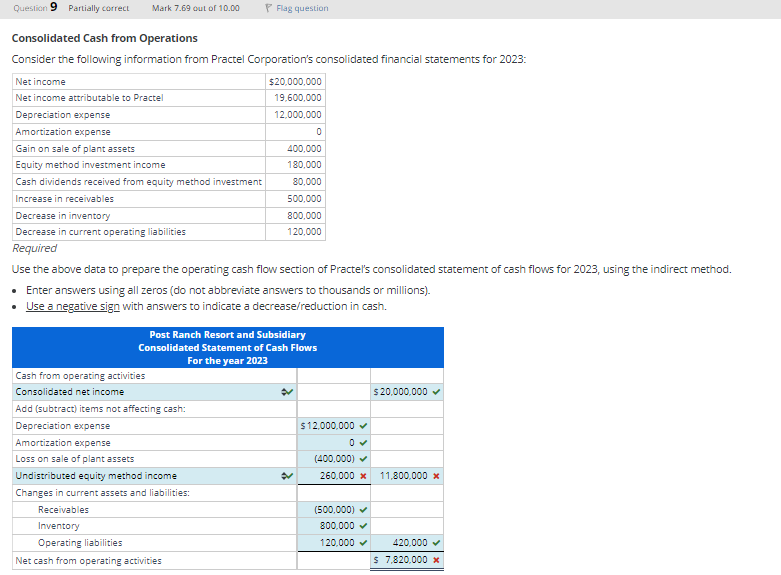

Consolidated Cash from Operations

Consider the following information from Practel Corporation's consolidated financial statements for :

tableNet income,$Net income attributable to Practel,Depreciation expense,Amortization expense,Gain on sale of plant assets,Equity method investment income,Cash dividends received from equity method investment,Increase in receivables,Decrease in inventory,Decrease in current operating liabilities,

Required

Use the above data to prepare the operating cash flow section of Practel's consolidated statement of cash flows for using the indirect method.

Enter answers using all zeros do not abbreviate answers to thousands or millions

Use a negative sign with answers to indicate a decreasereduction in cash.

tablePost Ranch Resort and Subsidiary Consolidated Statement of Cash Flows For the year Cash from operating activitiesConsolidated net income ot$Add subtract items not affecting cash:Depreciation expense,$Amortization expense,Loss on sale of plant assets,Undistributed equity method income totimes times Changes in current assets and liabilities:ReceivablesInventoryOperating liabilities,Net cash from operating activities,,$x Consolidation Eliminating Entries, First Year

for its investment in slattery on its own books.

a Calculate the goodwill reported for this acquisition, and its allocation to Packer and to the noncontrolling interest in Slattery.

b Calculate equity in net loss for reported by Slattery, and the noncontrolling interest in Slattery's net loss for reported on the consolidated income statement.

Note: Use negative signs with answers that reduce net income amounts.

c Prepare eliminating entries and necessary to consolidate the separate trial balances of Packer and Slattery at December

d At what amount is the noncontrolling interest in Slattery reported on the December consolidated balance sheet? Consolidation Eliminating Entries, Date of Acquisition and Two Years Later

Fiant and equipment, ycar life, straightline, is overvalued by $

Previously unrecorded limited afe identifiable intanglbies, year life, straightline, were valued at

Stardust's equity accounts at the date of aequasition were as follows:

fecquined

Caloulste the original goodwil for this acquistion and its alocation to controling and noncontrolling interests. In what ratio is goodwill alocated between controlling and noncontrolling interests?

Enter your answers in thousands $ equals $ in thousands

Enter your ratio answers in pertentages.

b Prepare the consolidation ellminating entries and F at the date of acquasition.

Enter your answers in thousands $ equals $ in thousands

C Prepare the consolidation eliminating entries CERO and ND at December

Enter your answers in thousands, using decimals if appropriste $ cquals $ in thousandsThis question.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock