Question: QUESTION 9 Under the base case, a project is expected to have a variable cost per unit of S10 and an NPV of $120 million.

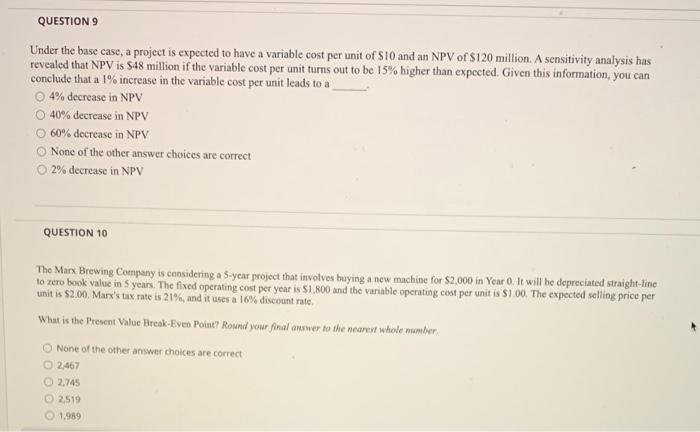

QUESTION 9 Under the base case, a project is expected to have a variable cost per unit of S10 and an NPV of $120 million. A sensitivity analysis bas revealed that NPV is 548 million if the variable cost per unit turns out to be 15% higher than expected. Given this information, you can conclude that a 1% increase in the variable cost per unit leads to a 4% decrease in NPV 40% decrease in NPV 60% decrease in NPV None of the other answer choices are correct O 2% decrease in NPV QUESTION 10 The Marx Brewing Company is considering a 5-year project that involves buying a new machine for $2,000 in Year 0. It will be depreciated straight-tino to zero book value in 5 years. The fixed operating cost per year is $1,800 and the variable operating cost per unit is $1.00. The expected selling price per unit is $2.00. Marx's tax rate is 21%, and it uses a 16% discount rate What is the Present Value Break-Even Point? Round your final answer to the nearest whole number None of the other answer choices are correct 2,467 2,745 2.519 1.989

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts