Question: question a) question b.i) & ii) please show working tq!! a. Given the following information, what is the value of d as it is used

question a)

question b.i) & ii)

please show working tq!!

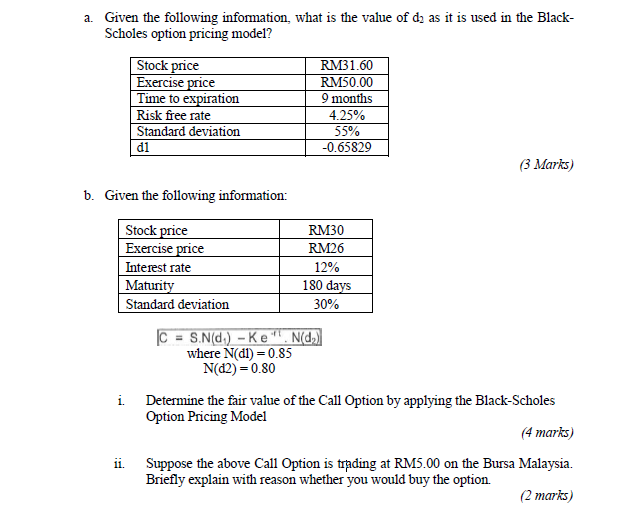

a. Given the following information, what is the value of d as it is used in the Black- Scholes option pricing model? Stock price Exercise price Time to expiration Risk free rate Standard deviation d1 RM31.60 RM50.00 9 months 4.25% 55% -0.65829 (3 Marks) 6. Given the following information: Stock price Exercise price Interest rate Maturity Standard deviation RM30 RM26 12% 180 days 30% C = S.N(d) - Ke". Nd.) where N(dl) = 0.85 N(d2) = 0.80 i Determine the fair value of the Call Option by applying the Black-Scholes Option Pricing Model (4 marks) ii. Suppose the above Call Option is trading at RM5.00 on the Bursa Malaysia. Briefly explain with reason whether you would buy the option (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts