Question: Question: Apply the AFN formula method to calculate Caterpillar's additional funds needed (AFN) corresponding to the projected sales growth (-22.80%) for the whole Year 2020.

Question: Apply the "AFN formula" method to calculate Caterpillar's additional funds needed (AFN) corresponding to the projected sales growth (-22.80%) for the whole Year 2020. and what items on financial statements are operating-related and will thus be proportionally (linearly) growing/changing along with sales, and what items are non-operating-related?"

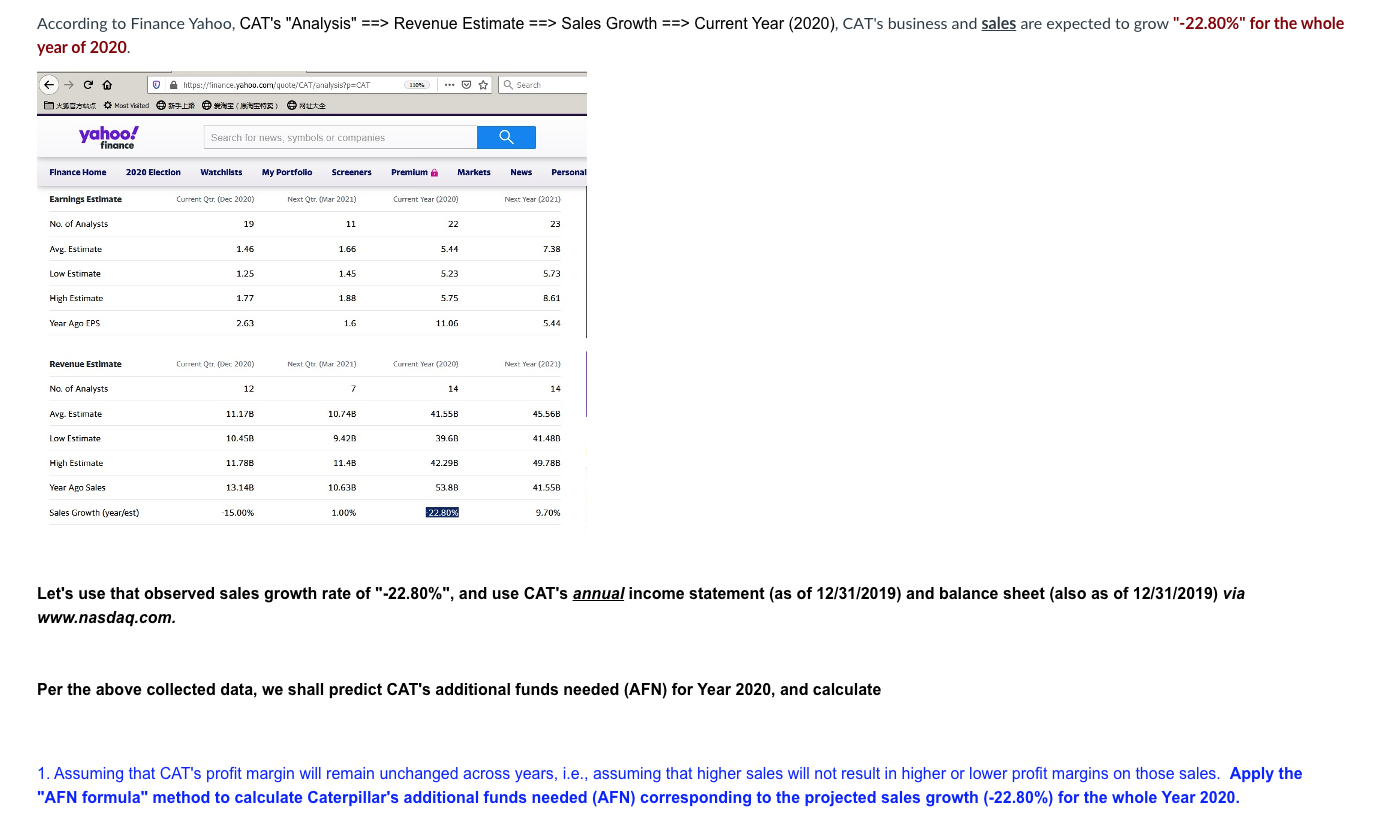

According to Finance Yahoo, CAT's "Analysis" ==> Revenue Estimate ==> Sales Growth ==> Current Year (2020), CAT's business and sales are expected to grow "-22.80%" for the whole year of 2020. https://finance.yahoo.com/quote/CAT/analysis?p=CAT Most Visited () yahoo! finance xuxe Search for news, symbols or companies 110% Q Search Finance Home 2020 Election Earnings Estimate Watchlists My Portfolio Screeners Premium Current Qtr. (Dec 2020) Next Qtr. (Mar 2021) Current Year (2020) Markets News Personal Next Year (2021) No. of Analysts 19 11 23 Avg. Estimate 1.46 1.66 5.44 7.38 Low Estimate 1.25 1.45 5.23 5.73 High Estimate 1.77 1.88 5.75 8.61 Year Ago EPS 2.63 1.6 11.06 5.44 Revenue Estimate Current Qtr. (Dec 2020) Next Qtr. (Mar 2021) Current Year (2020) Next Year (2021) 12 7 14 14 No. of Analysts Avg. Estimate 11.17B 10.748 41.55B 45.56B Low Estimate 10.458 9.42B 39.68 41.480 High Estimate 11.78B 11.4B 42.29B 49.78B Year Ago Sales 13.148 10.63B 53.88 41.558 Sales Growth (year/est) -15.00% 1.00% 22.80% 9.70% Let's use that observed sales growth rate of "-22.80%", and use CAT's annual income statement (as of 12/31/2019) and balance sheet (also as of 12/31/2019) via www.nasdaq.com. Per the above collected data, we shall predict CAT's additional funds needed (AFN) for Year 2020, and calculate 1. Assuming that CAT's profit margin will remain unchanged across years, i.e., assuming that higher sales will not result in higher or lower profit margins on those sales. Apply the "AFN formula" method to calculate Caterpillar's additional funds needed (AFN) corresponding to the projected sales growth (-22.80%) for the whole Year 2020.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts