Question: Miss Coos purchased a building to be used as her personal residence for a cost of $360,000. Of this total, it is estimated that

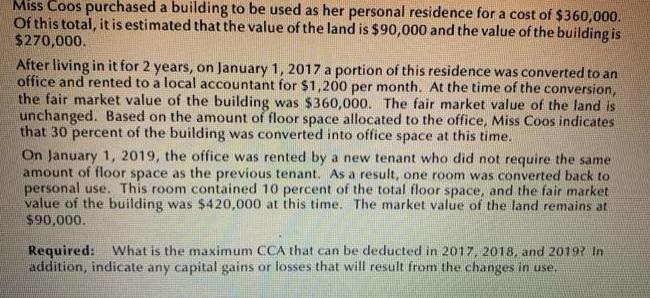

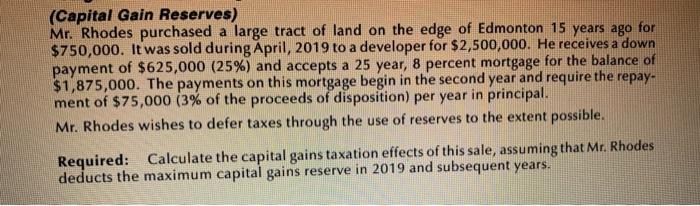

Miss Coos purchased a building to be used as her personal residence for a cost of $360,000. Of this total, it is estimated that the value of the land is $90,000 and the value of the building is $270,000. After living in it for 2 years, on January 1, 2017 a portion of this residence was converted to an office and rented to a local accountant for $1,200 per month. At the time of the conversion, the fair market value of the building was $360,000. The fair market value of the land is unchanged. Based on the amount of floor space allocated to the office, Miss Coos indicates that 30 percent of the building was converted into office space at this time. On January 1, 2019, the office was rented by a new tenant who did not require the same amount of floor space as the previous tenant. As a result, one room was converted back to personal use. This room contained 10 percent of the total floor space, and the fair market value of the building was $420,000 at this time. The market value of the land remains at $90,000. Required: What is the maximum CCA that can be deducted in 2017, 2018, and 20197 In addition, indicate any capital gains or losses that will result from the changes in use, (Capital Gain Reserves) Mr. Rhodes purchased a large tract of land on the edge of Edmonton 15 years ago for $750,000. It was sold during April, 2019 to a developer for $2,500,000. He receives a down payment of $625,000 (25%) and accepts a 25 year, 8 percent mortgage for the balance of $1,875,000. The payments on this mortgage begin in the second year and require the repay- ment of $75,000 (3% of the proceeds of disposition) per year in principal. Mr. Rhodes wishes to defer taxes through the use of reserves to the extent possible. Required: Calculate the capital gains taxation effects of this sale, assuming that Mr. Rhodes deducts the maximum capital gains reserve in 2019 and subsequent years.

Step by Step Solution

3.27 Rating (150 Votes )

There are 3 Steps involved in it

Part 1 for rental purpose buildings are classified under class 1 and the CCA rate will be 4 yearly deduction will be First year half of the cost x 4 x ... View full answer

Get step-by-step solutions from verified subject matter experts