Question: Question: Assuming a pure bundling strategy, what will be the price of the bundle and the resulting profit, student surplus, and total surplus? Explain with

Question: Assuming a pure bundling strategy, what will be the price of the bundle and the resulting profit, student surplus, and total surplus?

Question: Assuming a pure bundling strategy, what will be the price of the bundle and the resulting profit, student surplus, and total surplus?

Explain with steps if possible. I dont understand the logic with this question.

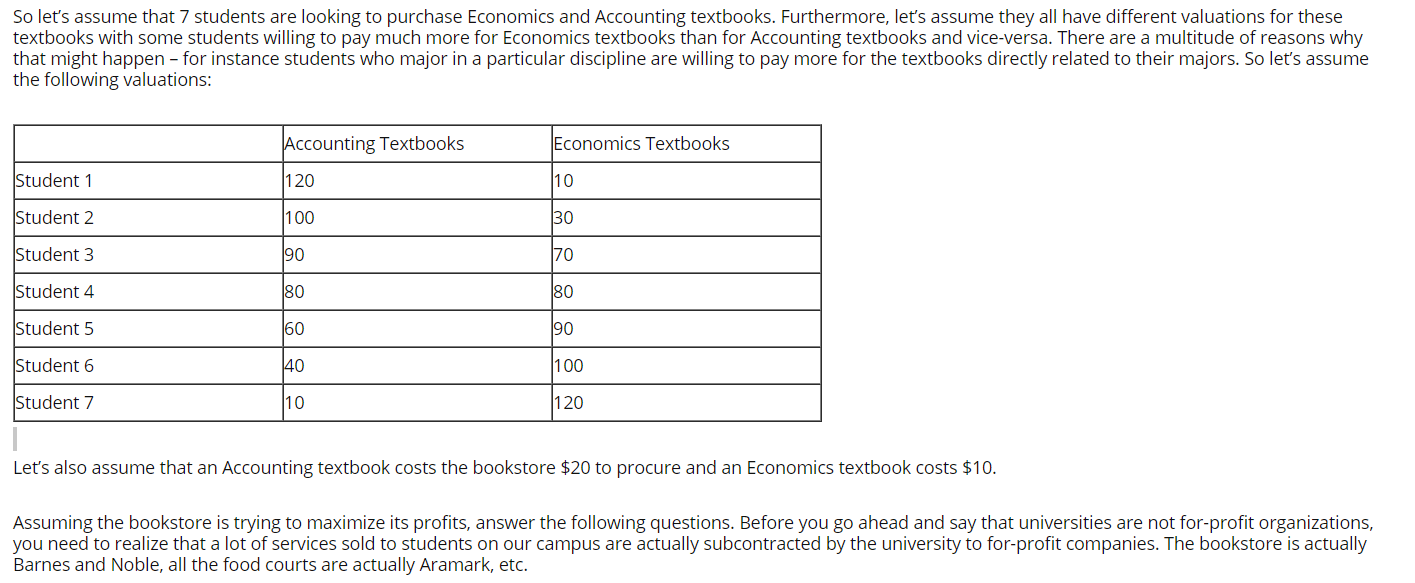

So let's assume that 7 students are looking to purchase Economics and Accounting textbooks. Furthermore, let's assume they all have different valuations for these textbooks with some students willing to pay much more for Economics textbooks than for Accounting textbooks and vice-versa. There are a multitude of reasons why that might happen - for instance students who major in a particular discipline are willing to pay more for the textbooks directly related to their majors. So let's assume the following valuations: Accounting Textbooks Economics Textbooks Student 1 120 10 Student 2 100 30 Student 3 90 170 Student 4 80 180 Student 5 160 190 Student 6 40 100 Student 7 10 120 Let's also assume that an Accounting textbook costs the bookstore $20 to procure and an Economics textbook costs $10. Assuming the bookstore is trying to maximize its profits, answer the following questions. Before you go ahead and say that universities are not for-profit organizations, you need to realize that a lot of services sold to students on our campus are actually subcontracted by the university to for-profit companies. The bookstore is actually Barnes and Noble, all the food courts are actually Aramark, etc. So let's assume that 7 students are looking to purchase Economics and Accounting textbooks. Furthermore, let's assume they all have different valuations for these textbooks with some students willing to pay much more for Economics textbooks than for Accounting textbooks and vice-versa. There are a multitude of reasons why that might happen - for instance students who major in a particular discipline are willing to pay more for the textbooks directly related to their majors. So let's assume the following valuations: Accounting Textbooks Economics Textbooks Student 1 120 10 Student 2 100 30 Student 3 90 170 Student 4 80 180 Student 5 160 190 Student 6 40 100 Student 7 10 120 Let's also assume that an Accounting textbook costs the bookstore $20 to procure and an Economics textbook costs $10. Assuming the bookstore is trying to maximize its profits, answer the following questions. Before you go ahead and say that universities are not for-profit organizations, you need to realize that a lot of services sold to students on our campus are actually subcontracted by the university to for-profit companies. The bookstore is actually Barnes and Noble, all the food courts are actually Aramark, etc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts