Question: Question B (Intrinsic Value and Time Value). Let ANZ common shares be the selected underlying asset. Choose one particular time-to-expiry between one to nine months,

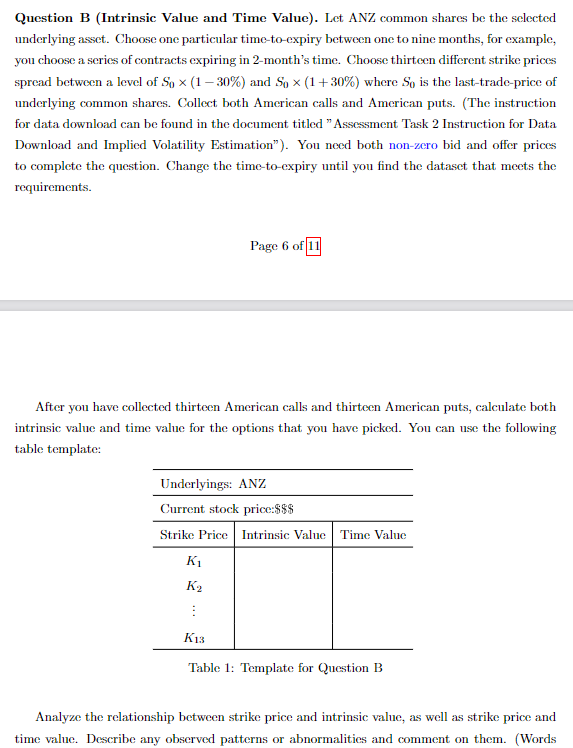

Question B (Intrinsic Value and Time Value). Let ANZ common shares be the selected underlying asset. Choose one particular time-to-expiry between one to nine months, for example, you choose a series of contracts expiring in 2-month's time. Choose thirteen different strike prices spread between a level of S0(130%) and S0(1+30%) where S0 is the last-trade-price of underlying common shares. Collect both American calls and American puts. (The instruction for data download can be found in the document titled "Assessment Task 2 Instruction for Data Download and Implied Volatility Estimation"). You need both non-zero bid and offer prices to complete the question. Change the time-to-expiry until you find the dataset that meets the requirements. Page 6 of 11 After you have collected thirteen American calls and thirteen American puts, calculate both intrinsic value and time value for the options that you have picked. You can use the following table template: Table 1: Template for Question B Analyze the relationship between strike price and intrinsic value, as well as strike price and time value. Describe any observed patterns or abnormalities and comment on them. (Words

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts