Question: Question B2 (Quantification of Covered Call Writing). Use data presented in Figure to answer the following. Assume you write BHPWL9 to have a in-the-money covered

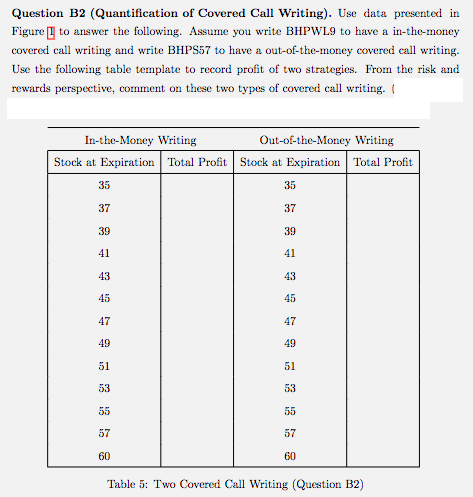

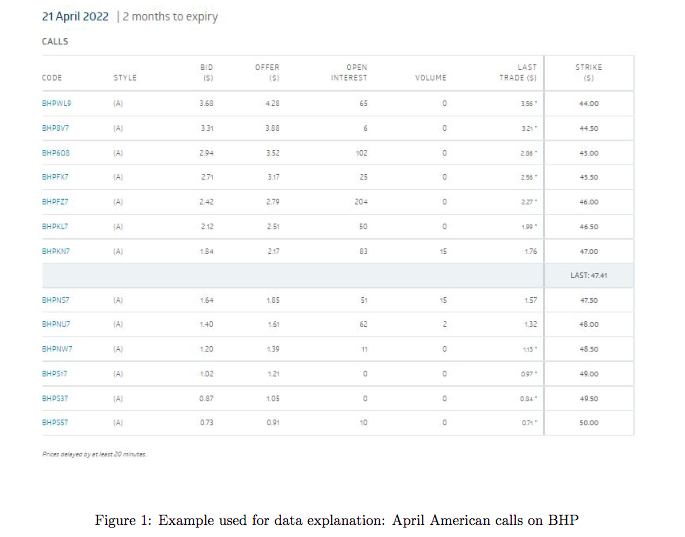

Question B2 (Quantification of Covered Call Writing). Use data presented in Figure to answer the following. Assume you write BHPWL9 to have a in-the-money covered call writing and write BHPS57 to have a out-of-the-money covered call writing. Use the following table template to record profit of two strategies. From the risk and rewards perspective, comment on these two types of covered call writing. In-the-Money Writing Out-of-the-Money Writing Stock at Expiration Total Profit Stock at Expiration Total Profit 35 35 37 37 39 39 41 41 43 43 45 45 47 47 49 49 51 51 53 53 55 55 57 57 60 60 Table 5: Two Covered Call Writing (Question B2) 21 April 2022 | 2 months to expiry CALLS STRIKE OFFER (5) CODE STYLE (5) BHPWL9 (A) 3.68 4.29 44.00 BHPBV7 (A) 3.31 3.00 44.50 BHP608 (A) 2.94 3.52 45.00 BHPFX7 (A) 2.71 3.17 45.30 BHPFZ7 (A) 242 2,79 46.00 BHPKL7 (A) 2.12 2:51 46.50 BHPKN7 (A) 1.84 2:17 47.00 LAST: 47.41 BHPNS7 (A) 1.05 47.50 BHPNU7 1.40 1.61 48.00 BHPNW7 1.20 1.39 48.50 BHPS17 1.02 1.21 49.00 BHPS37 0.87 1.05 49.50 BHPS57 (A) 0.73 0.91 10 0 50.00 Prices delayed by at least 20 minutes Figure 1: Example used for data explanation: April American calls on BHP (A) 7 OPEN INTEREST 65 6 102 25 204 50 83 51 62 11 0 0 VOLUME 0 0 0 0 0 0 15 15 2 0 0 0 LAST TRADE ($) 3.56" 2.06 256 227 1.99 1.76 1.57 1.32 0.97

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts