Question: Question B2 (Quantification of Covered Call Writing). Use data presented in Figure 1 to answer the following. Assume you write BHPWL9 to have a in-the-money

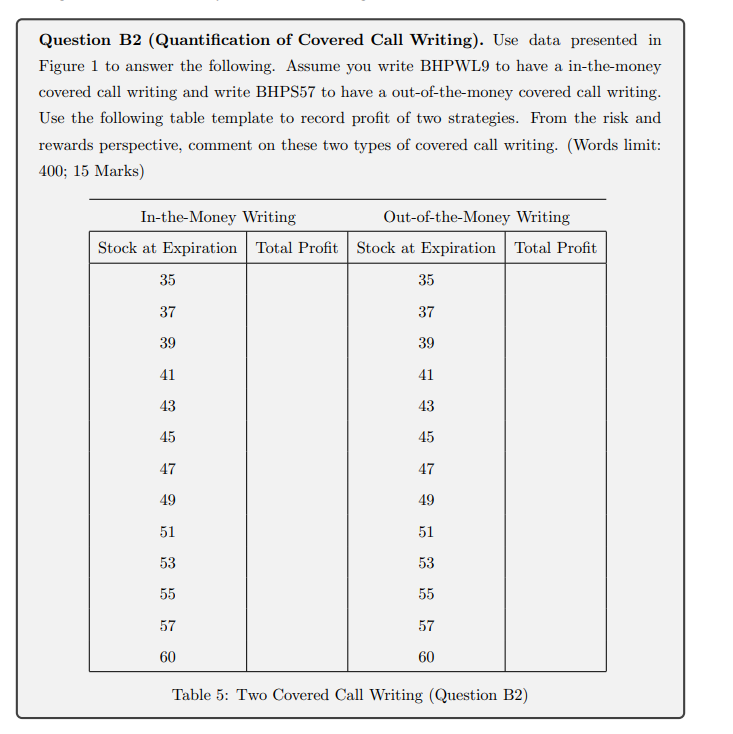

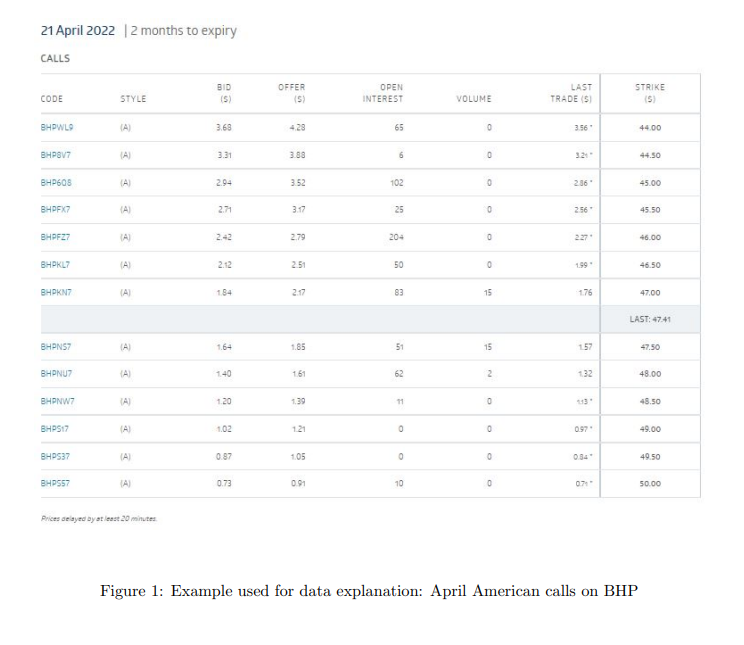

Question B2 (Quantification of Covered Call Writing). Use data presented in Figure 1 to answer the following. Assume you write BHPWL9 to have a in-the-money covered call writing and write BHPS57 to have a out-of-the-money covered call writing. Use the following table template to record profit of two strategies. From the risk and rewards perspective, comment on these two types of covered call writing. (Words limit: 400; 15 Marks) In-the-Money Writing Out-of-the-Money Writing Stock at Expiration Total Profit Stock at Expiration Total Profit 35 35 37 37 39 39 41 41 43 43 45 45 47 47 49 49 51 51 53 53 55 55 57 57 60 60 Table 5: Two Covered Call Writing (Question B2) 21 April 2022 2 months to expiry CALLS BID (5) OPEN INTEREST OFFER 15) LAST TRADES STRIKE 15 CODE STYLE VOLUME BHPWL IA 3.69 429 65 0 3.56 4400 BHP8V7 Al 3.31 3.89 6 0 32 44.50 BHP603 A 2.94 3.52 102 236 45.00 BHPFX7 (A) 2.71 3.17 25 0 256 45.50 BHPFZ7 (A) 2.42 2.79 204 0 227 46.00 BHPKL A 2.12 2.51 50 0 199 46.50 EHPE M7 A A 134 2.17 83 15 176 47.00 LAST: 47.41 BHPNS A 1.64 1.85 51 15 157 47.50 BHPNUZ A 140 161 62 2 132 48.00 BHPNW7 1.20 1.39 11 0 48.50 BHPS17 (A) (A) A 1.02 121 0 0 0 0.97 49.00 BHPS37 A 0.87 105 0 0 0.34 40 50 BHPS57 A 0.73 091 10 0 07 50.00 Prices delayed by a 20 minutes Figure 1: Example used for data explanation: April American calls on BHP Question B2 (Quantification of Covered Call Writing). Use data presented in Figure 1 to answer the following. Assume you write BHPWL9 to have a in-the-money covered call writing and write BHPS57 to have a out-of-the-money covered call writing. Use the following table template to record profit of two strategies. From the risk and rewards perspective, comment on these two types of covered call writing. (Words limit: 400; 15 Marks) In-the-Money Writing Out-of-the-Money Writing Stock at Expiration Total Profit Stock at Expiration Total Profit 35 35 37 37 39 39 41 41 43 43 45 45 47 47 49 49 51 51 53 53 55 55 57 57 60 60 Table 5: Two Covered Call Writing (Question B2) 21 April 2022 2 months to expiry CALLS BID (5) OPEN INTEREST OFFER 15) LAST TRADES STRIKE 15 CODE STYLE VOLUME BHPWL IA 3.69 429 65 0 3.56 4400 BHP8V7 Al 3.31 3.89 6 0 32 44.50 BHP603 A 2.94 3.52 102 236 45.00 BHPFX7 (A) 2.71 3.17 25 0 256 45.50 BHPFZ7 (A) 2.42 2.79 204 0 227 46.00 BHPKL A 2.12 2.51 50 0 199 46.50 EHPE M7 A A 134 2.17 83 15 176 47.00 LAST: 47.41 BHPNS A 1.64 1.85 51 15 157 47.50 BHPNUZ A 140 161 62 2 132 48.00 BHPNW7 1.20 1.39 11 0 48.50 BHPS17 (A) (A) A 1.02 121 0 0 0 0.97 49.00 BHPS37 A 0.87 105 0 0 0.34 40 50 BHPS57 A 0.73 091 10 0 07 50.00 Prices delayed by a 20 minutes Figure 1: Example used for data explanation: April American calls on BHP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts