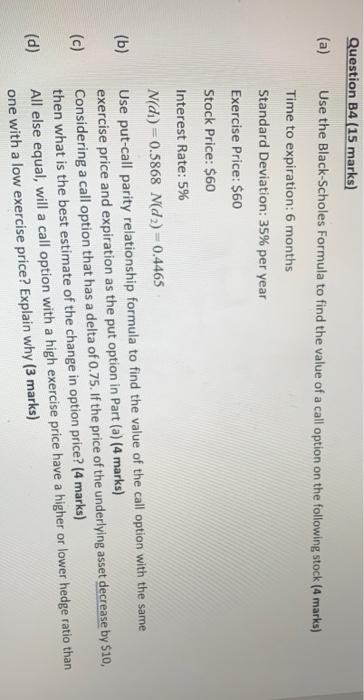

Question: Question B4 (15 marks) (a) Use the Black-Scholes Formula to find the value of a call option on the following stock (4 marks) Time to

Question B4 (15 marks) (a) Use the Black-Scholes Formula to find the value of a call option on the following stock (4 marks) Time to expiration: 6 months Standard Deviation: 35% per year Exercise Price: $60 Stock Price: $60 Interest Rate: 5% N/di) = 0.5868 N(d) = 0.4465 (b) (c) c Use put-call parity relationship formula to find the value of the call option with the same exercise price and expiration as the put option in Part (a) (4 marks) Considering a call option that has a delta of 0.75. If the price of the underlying asset decrease by $10, then what is the best estimate of the change in option price? (4 marks) All else equal, will a call option with a high exercise price have a higher or lower hedge ratio than one with a low exercise price? Explain why (3 marks) (d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts