Question: Chapter 16 Problem 10 & 11 Problem 10: Use the Black-Scholes formula to find the value of a call option on the following stock: Time

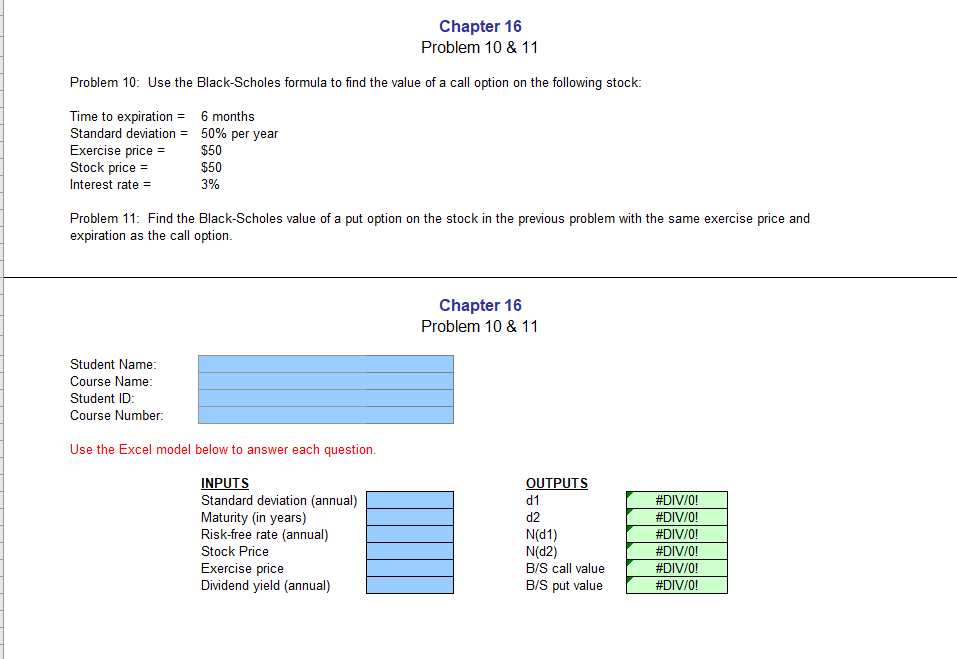

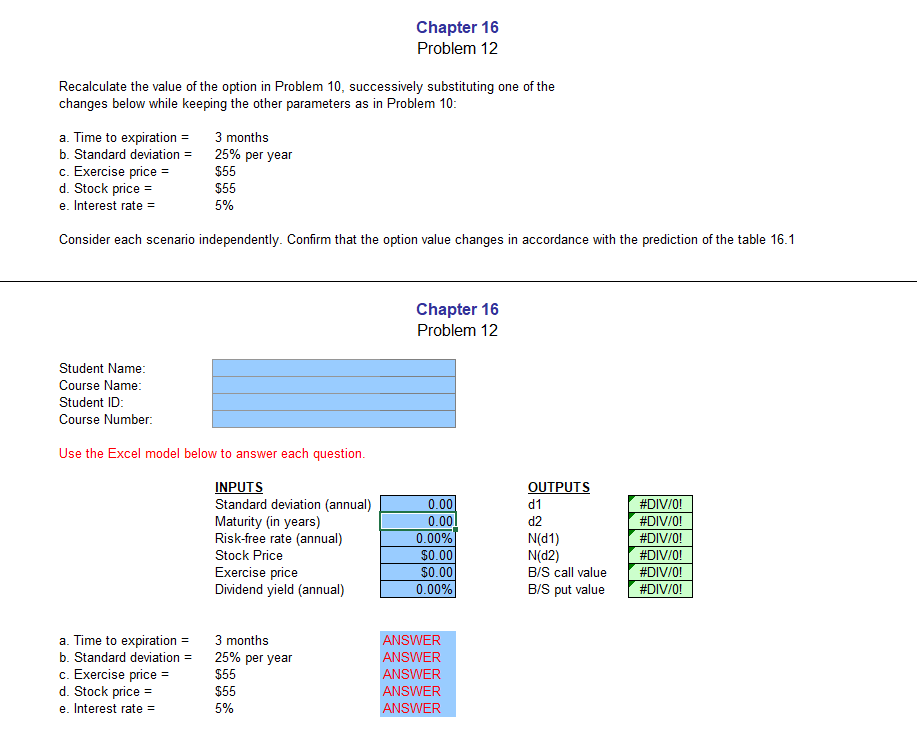

Chapter 16 Problem 10 & 11 Problem 10: Use the Black-Scholes formula to find the value of a call option on the following stock: Time to expiration 6 months Standard deviation = 50% per year Exercise price = $50 Stock price = $50 Interest rate = 3% Problem 11: Find the Black-Scholes value of a put option on the stock in the previous problem with the same exercise price and expiration as the call option. Chapter 16 Problem 10 & 11 Student Name: Course Name: Student ID: Course Number: Use the Excel model below to answer each question. INPUTS Standard deviation (annual) Maturity (in years) Risk-free rate (annual) Stock Price Exercise price Dividend yield (annual) OUTPUTS d1 d2 N(D1) Nd2) B/S call value B/S put value #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! Chapter 16 Problem 12 Recalculate the value of the option in Problem 10, successively substituting one of the changes below while keeping the other parameters as in Problem 10: a. Time to expiration = 3 months b. Standard deviation = 25% per year c. Exercise price = $55 d. Stock price = $55 e. Interest rate = 5% Consider each scenario independently. Confirm that the option value changes in accordance with the prediction of the table 16.1 Chapter 16 Problem 12 Student Name: Course Name: Student ID: Course Number: Use the Excel model below to answer each question. INPUTS Standard deviation (annual) Maturity (in years) Risk-free rate (annual) Stock Price Exercise price Dividend yield (annual) 0.00 0.001 0.00% $0.00 $0.00 0.00% OUTPUTS d1 d2 N(1) N(d2) B/S call value B/S put value #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! a. Time to expiration = b. Standard deviation = c. Exercise price = d. Stock price = e. Interest rate = 3 months 25% per year $55 $55 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts