Question: Question c please 1) A consumer has utility function U(x)=x1+x2. (a) Find his Marshallian demand D(p,I) and indirect utility function V(p,I). The consumer has income

Question c please

Question c please

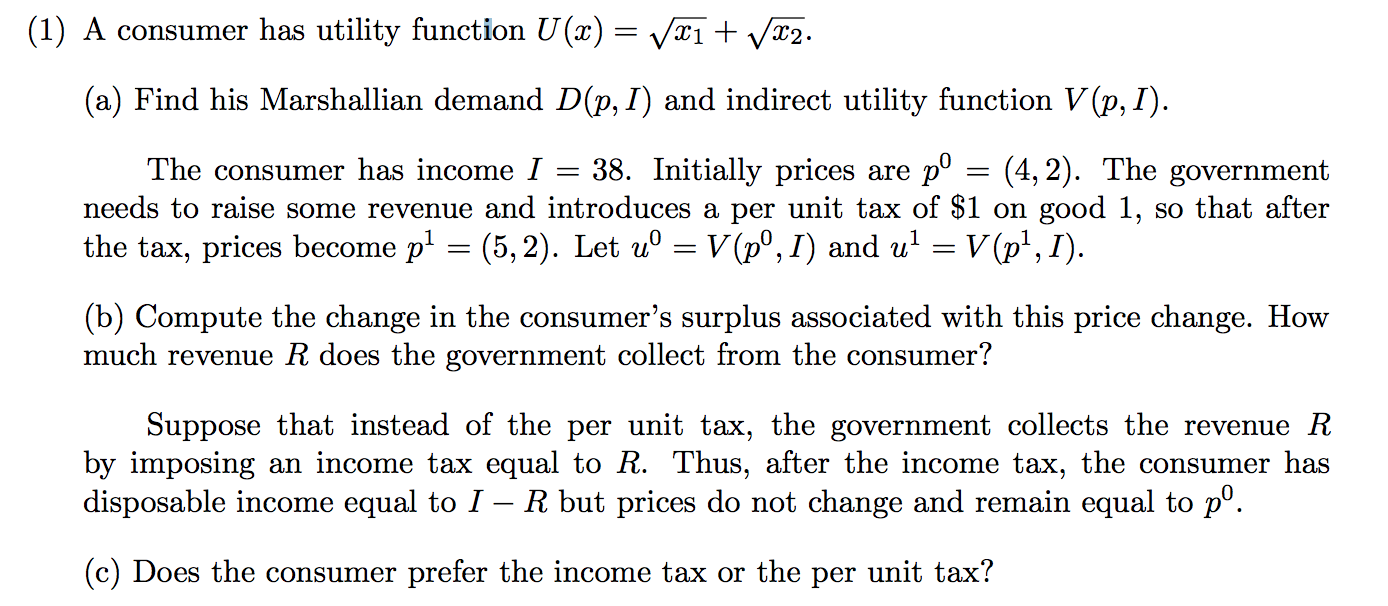

1) A consumer has utility function U(x)=x1+x2. (a) Find his Marshallian demand D(p,I) and indirect utility function V(p,I). The consumer has income I=38. Initially prices are p0=(4,2). The government needs to raise some revenue and introduces a per unit tax of $1 on good 1 , so that after the tax, prices become p1=(5,2). Let u0=V(p0,I) and u1=V(p1,I). (b) Compute the change in the consumer's surplus associated with this price change. How much revenue R does the government collect from the consumer? Suppose that instead of the per unit tax, the government collects the revenue R by imposing an income tax equal to R. Thus, after the income tax, the consumer has disposable income equal to IR but prices do not change and remain equal to p0. (c) Does the consumer prefer the income tax or the per unit tax? 1) A consumer has utility function U(x)=x1+x2. (a) Find his Marshallian demand D(p,I) and indirect utility function V(p,I). The consumer has income I=38. Initially prices are p0=(4,2). The government needs to raise some revenue and introduces a per unit tax of $1 on good 1 , so that after the tax, prices become p1=(5,2). Let u0=V(p0,I) and u1=V(p1,I). (b) Compute the change in the consumer's surplus associated with this price change. How much revenue R does the government collect from the consumer? Suppose that instead of the per unit tax, the government collects the revenue R by imposing an income tax equal to R. Thus, after the income tax, the consumer has disposable income equal to IR but prices do not change and remain equal to p0. (c) Does the consumer prefer the income tax or the per unit tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts