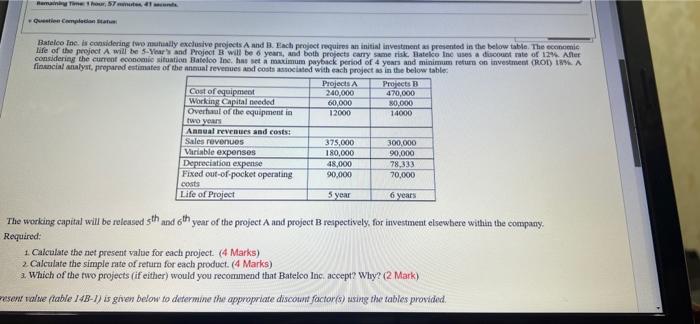

Question: Question Completion Batelco Inc. is considering two mutually exclusive projects A and B. Each project requires an initial investment as presented in the below table.

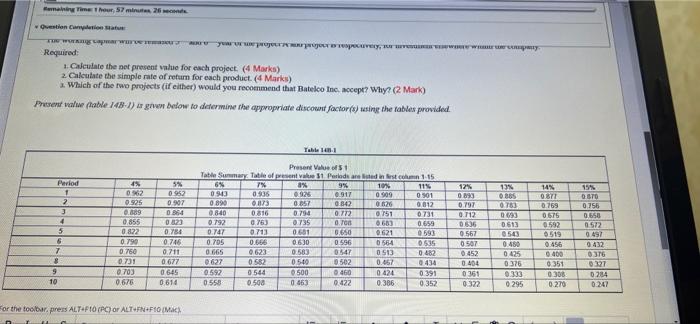

Question Completion Batelco Inc. is considering two mutually exclusive projects A and B. Each project requires an initial investment as presented in the below table. The economic life of the project A will be 5-Year's and Project B will be 6 years, and both projects carry same risk. Batelco Inc uses a discount rate of 12%. After considering the current economic situation Batelco Inc. has set a maximum payback period of 4 years and minimum return on investment (ROI) 18% A financial analyst, prepared estimates of the annual revenues and costs associated with each project as in the below table: Projects B Cost of equipment Projects A 240,000 470,000 60,000 80,000 Working Capital needed Overhaul of the equipment in two years 12000 14000 Annual revenues and costs: Sales revenues 375,000 300,000 Variable expenses 180,000 90,000 Depreciation expense 48,000 78,333 Fixed out-of-pocket operating 90,000 70,000 costs Life of Project 5 year 6 years The working capital will be released 5th and 6th year of the project A and project B respectively, for investment elsewhere within the company. Required: 1. Calculate the net present value for each project. (4 Marks) 2. Calculate the simple rate of return for each product. (4 Marks) 3. Which of the two projects (if either) would you recommend that Batelco Inc. accept? Why? (2 Mark) resent value (table 14B-1) is given below to determine the appropriate discount factor(s) using the tables provided. Remaining Time: 1 hour, 57 minutes, 26 seconds Question Completion Statu The working capmar war ve re Required: 1. Calculate the net present value for each project. (4 Marks) 2 Calculate the simple rate of return for each product. (4 Marks) a. Which of the two projects (if either) would you recommend that Batelco Inc. accept? Why? (2 Mark) Present value (table 148-1) is given below to determine the appropriate discount factor(s) using the tables provided Table 148-1 Present Value of Table Summary Table of present value $1. Periods are listed in Sest column 1-15 4% 5% 6% 7% 8% 9% 10% 11% Period 1 0.962 0.952 0.943 0.936 0.926 0.917 0.909 0.501 2 0.925 0.907 0.890 0.873 0.057 0842 0.526 0812 0.889 0.864 0.840 0.816 0.794 0.772 0751 0731 0.855 0.823 0.792 0.763 0735 0.700 0.683 0.659 0.822 0.784 0.747 0.713 0.601 0.650 0.621 0.593 0.790 0.746 0.705 0.666 0.630 0.596 0564 0.535 0.760 0.711 0.665 0.623 0.583 0547 0513 0.482 0.731 0.677 0627 0.582 0540 0502 0.467 0434 9 0.703 0645 0.592 0544 0500 0.460 0.391 0.424 10 0.676 0422 0.614 0.558 0.508 0.463 0.386 0.352 For the toolbar, press ALT+F10 (PC) or ALT+FN+F10(Mac) 3 4 5 6 7 8 year or use project mur project is respocuvery, ves company. 14% 0.877 0.769 0.675 0.592 0519 0.456 0400 0.351 0.308 0.270 12% 0.893 0.797 0.712 0.636 0.567 0507 0.452 0.404 0361 0.322 13% 0.865 0.783 0693 0613 0543 0.450 0.425 0.376 0.333 0.295 17 T 15% 0670 0.756 0.658 0.572 0.497 0432 0.376 0327 0284 0.247

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts