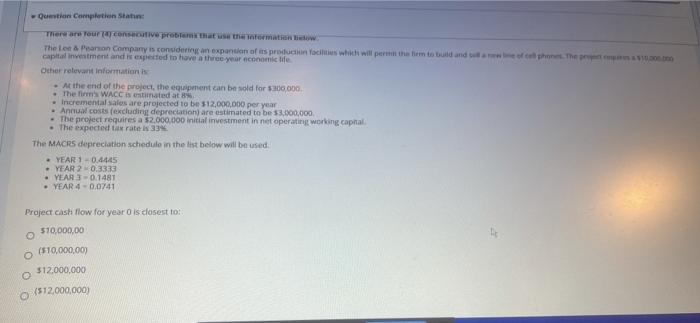

Question: Question Completion Statin There are your consecutive problem that the formation Theo Parman Company is considering an expansion of its producties which will per them

Question Completion Statin There are your consecutive problem that the formation Theo Parman Company is considering an expansion of its producties which will per them to build and then the capital investment and is expected to have three year economic life Other relevant informations At the end of the project, the equipment can be sold for $300.000 The WACC Istimated at Incremental sales are projected to be 312,000,000 per year Annual costs (excluding depreciation are estimated to be $3,000,000 The project requires a $2.000.000 initial investment in net operating working capital The expected tax rate 33 The MACRS depreciation schedule in the list below will be used YEAR 1-0.4445 YEAR 20.3333 YEAR 3 -0.1481 YEAR 4 -0.0741 Project cash flow for year is cosest to 510,000,00 ($10,000,000 O $12,000,000 (512,000,000)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts