Question: Question Completion Status: 10 20 13 3 40 50 60 70 80 90 10 11 12 14 15 16 17 18 19 20 21 22

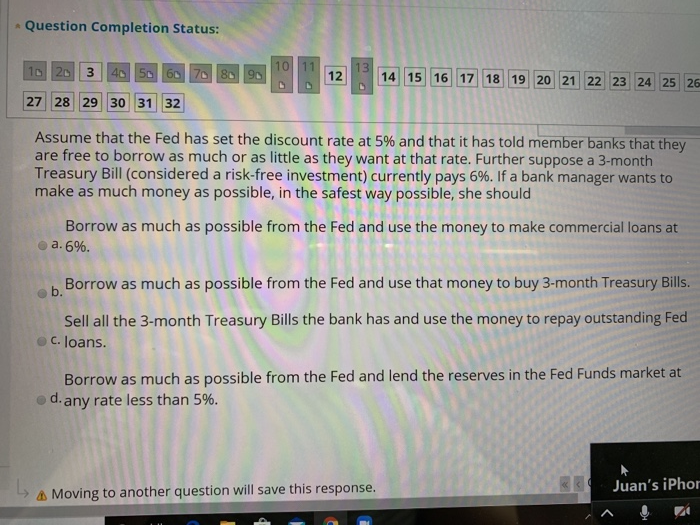

Question Completion Status: 10 20 13 3 40 50 60 70 80 90 10 11 12 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 Assume that the Fed has set the discount rate at 5% and that it has told member banks that they are free to borrow as much or as little as they want at that rate. Further suppose a 3-month Treasury Bill (considered a risk-free investment) currently pays 6%. If a bank manager wants to make as much money as possible, in the safest way possible, she should Borrow as much as possible from the Fed and use the money to make commercial loans at a. 6%. Borrow as much as possible from the Fed and use that money to buy 3-month Treasury Bills. b. Sell all the 3-month Treasury Bills the bank has and use the money to repay outstanding Fed C. loans. Borrow as much as possible from the Fed and lend the reserves in the Fed Funds market at d. any rate less than 5%. Juan's iPhor A Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts