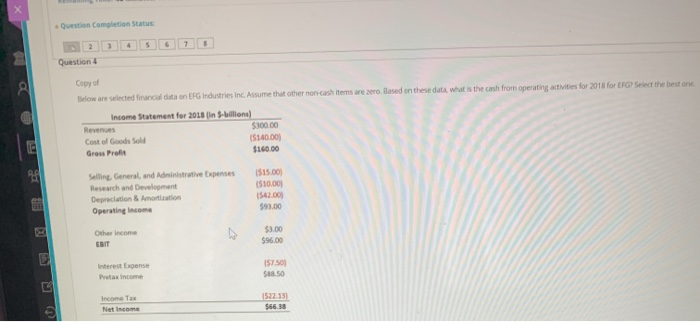

Question: Question Completion Status: 2 1 5 7 8 Question 4 Copy of Below are selected financial data on EFG Industries Inc. Assume that other non-cash

Question Completion Status: 2 1 5 7 8 Question 4 Copy of Below are selected financial data on EFG Industries Inc. Assume that other non-cash items are zero Based on these data, what is the cash from operating activities for 2018 for Select the best one Income Statement for 2018 in -billions) Revens $300 DO Cost of Goods Sold $140.000 Gross Profit Selling General, and Administrative Expenses Research and Development Depreciation & Amortization Operating income $15.00 1510.00 1542.00 $93.00 Other income ERIT $3.00 $96.00 Interest Expense Pretax income 157.500 $8.50 Income Tax Net Income 1522.13) $66.38 Income Tax Net Income 1522.13) $66.38 Cash & Short Term Investments Accounts Receivable Inventory Other Current Assets Total Current Assets Balance Sheet (in S-billions) 2018 2017 Liabilities $30.00 $30,00 Accounts Payable $38.00 $35.00 Short-Term Debt $15.00 $12.00 Current Maturities of Long-Term Debt $4.00 $3.80 Other Current Liabilities $87.00 $80.80 Total Current Liabilities 2018 2017 $26.00 $24.00 $10.00 $9.50 $15.00 $14.25 $15.00 $14.25 $66.00 $62.00 Property. Plant & Equipment $120.00 $114.00 Long-Term Debt Less Accumulated Depreciation 1$40,00) 1538.00) Capital Lease Obligations Net Property, Plant & Equipment $80.00 $76.00 Total Debt $80.00 $76.00 $0.00 $0.00 $80.00 $76.00 Goodwill & Intangible Assets Other Long-Term Assets $5.9 $4.75 Deferred Taxes $17.00 $16.15 Other Long-Term Liabilities ($12.00) ($11.40) $22.00 $20.90 Total Liabilities $156.00 $147.50 Shareholders' Equity $33.00 $10.20 $189.00 $177,70 Total Liabilities and Shareholders' Equity $189.00 $177.70 Total Assets OL 511238 billion OIL 581.38 billion II 520 38 bilion O IV. 510438 billion o BE P du 1 Type here to search acer F2 F5D F6 58 F9 Esc FL F4 F3 F75 # 3 $ 4 % 5. 2 7 LO W R

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts