Question: Question Completion Status: 2 3 100 128 13 1 56 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30

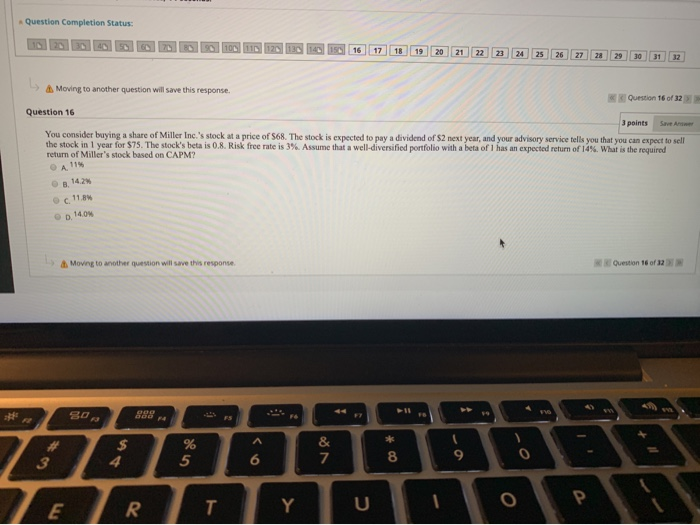

Question Completion Status: 2 3 100 128 13 1 56 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 Moving to another question will save this response Question 16 of 32 Question 16 3 points Save Ani You consider buying a share of Miller Inc.'s stock at a price of $68. The stock is expected to pay a dividend of S2 next year, and your advisory service tells you that you can expect to sell the stock in 1 year for $75. The stock's beta is 0.8. Risk free rate is 3%. Assume that a well-diversified portfolio with a beta of 1 has an expected return of 14%. What is the required return of Miller's stock based on CAPM? A 11% 8.142 c 118 14.05 Moving to another question will save this response Question 16 of 12 ZER, Y U TO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts