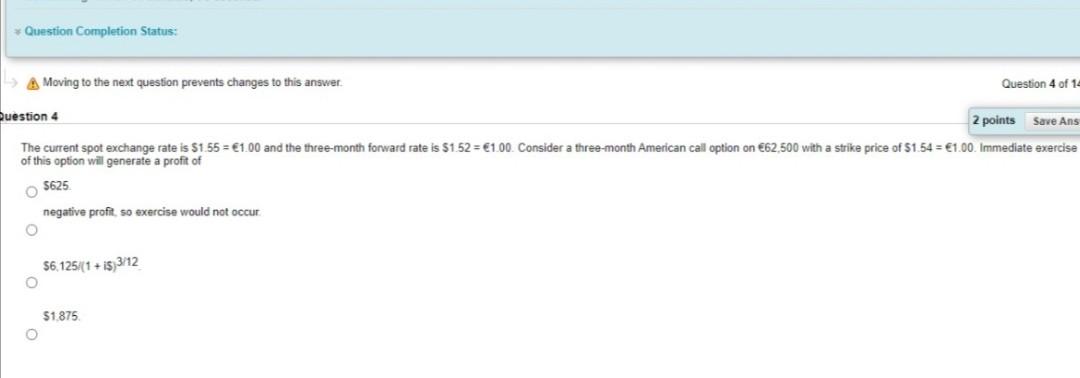

Question: Question Completion Status: > A Moving to the next question prevents changes to this answer Question 4 of 14 Question 4 2 points Save Ans

Question Completion Status: > A Moving to the next question prevents changes to this answer Question 4 of 14 Question 4 2 points Save Ans The current spot exchange rate is $1.55 = 1.00 and the three month forward rate is $1.52 = 1.00. Consider a three-month American call option on 62,500 with a strike price of $1.54 = 1.00. Immediate exercise of this option will generate a profit of $625 negative profit, so exercise would not occur 56,125/(1 + i5 3/12 $1.875

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts