Question: Question completion Status Moving to another question will save this response. Question 7 A pension fund manager is investing 40% of the investment budget on

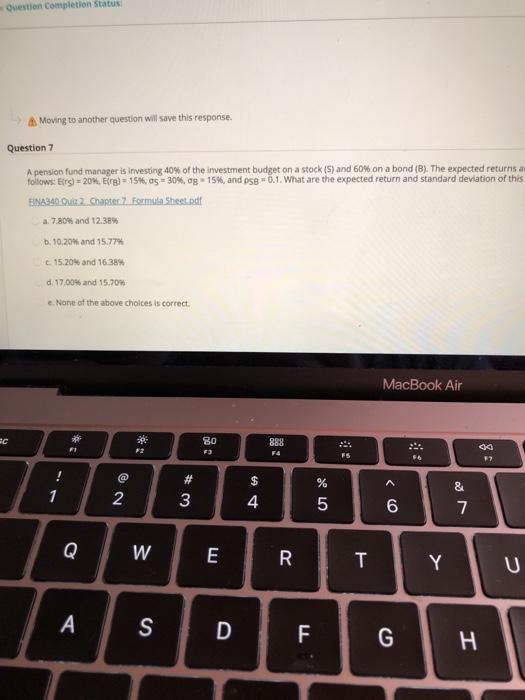

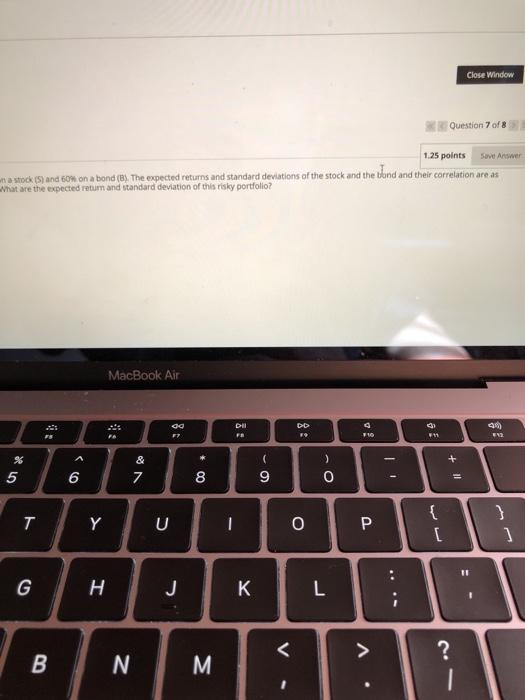

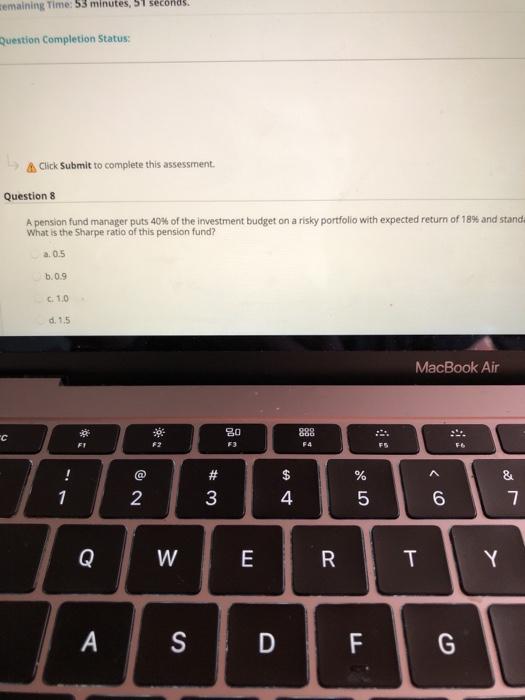

Question completion Status Moving to another question will save this response. Question 7 A pension fund manager is investing 40% of the investment budget on a stock (S) and 60% on a bond (B). The expected returns du followers) - 20. Erg) = 154. Os = 30%, og 154, and 58 -0.1. What are the expected return and standard deviation of this FINA340 O2.Canter 7 Formula Sheet.pdf 2. 7.804 and 12.38% b.10.204 and 15.77% 15.204 and 16.38% d. 17.00% and 15.70 e. None of the above choices is correct. MacBook Air c 80 F3 888 F4 75 90 17 56 @ $ & # 3 1 & 2 4 5 6 7 Q W E R Y U A S D G H Close Window Question 7 of 8 1.25 points Save Answer wnia stock (5) and 6 on a bond (8). The expected returns and standard deviations of the stock and the bond and their correlation are as What are the expected retum and standard deviation of this risky portfolio? MacBook Air ao DD DI FE 41 & 10 11 % 5 ) O W+ 6 7 8 9 T Y U 0 P { [ ] G H J L N M cremaining Time: 53 minutes, 51 seconds Question Completion Status: A Click Submit to complete this assessment. Question 8 A pension fund manager puts 40% of the investment budget on a risky portfolio with expected return of 18% and stand What is the Sharpe ratio of this pension fund? 20.5 6.0.9 C.1.0 d. 15 MacBook Air 80 C Soa F4 FT $2 F5 F6 @ & # 3 % 5 1 2 4 6 7 W E R T Y A S D F G Close Window Save and Submit Question of 1.25 points misky portfolio with expected return of 18% and standard deviation of 10 and puts the rest of the investment budget on T-bills with rate MacBook Air 00 PY DIA FB DD 39 . E % 5 V 0 00 * ) 0 . + 1 6 9 { [ 0 Y T U H G J L ? B N M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts