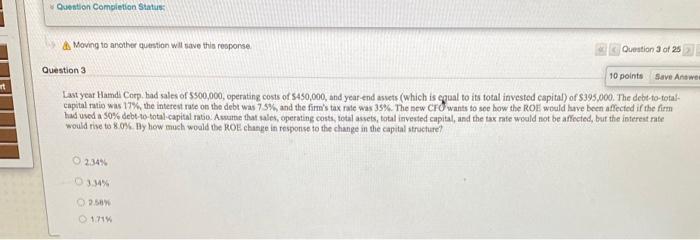

Question: Question Completion Status Moving to another question will save this response Question 3 of 25 It Question 3 10 pointe Save Answer Last year Hamdi

Question Completion Status Moving to another question will save this response Question 3 of 25 It Question 3 10 pointe Save Answer Last year Hamdi Cep had sales of $500,000, operating costs of S450,000, and year end assets (which is equal to its total invested capital of 395,000. The debt-to-total- capital ratio was 17% the interest rate on the debt was 73%, and the firm's tax rate was 35%. The new CFO wants to see how the ROE would have been affected if the firm had ved a 50% debt-to total capital to Asume that sales operating costs, total assets, total invested capital, and the tax nte would not be affected, but the interest rate would rise to 80%. Hy how much would the ROL change in response to the change in the capital structure? 2.34% 3.3% 2.50 171

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts