Question: Question Completion Status: Moving to another questions will save this response Question The firm you surely work or is looking to buy out a firm

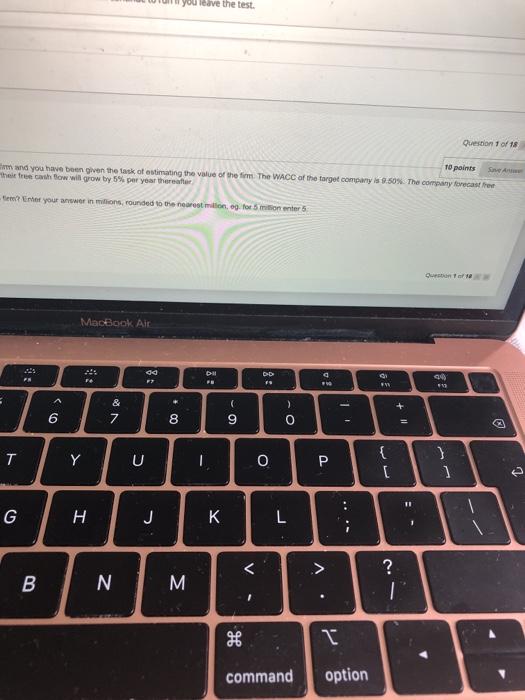

Question Completion Status: Moving to another questions will save this response Question The firm you surely work or is looking to buy out a firm and you have been given the task of estimating the value of the firm The WACC www.thecowe how of million for the next 3 years and forecast the fresh flow will grow by year theater Using cow model what is the value of them? Enter your answerin millions de tone for MacBook Air *** So go 8 WY $ % 2 E 3 # 4 5 or > & 7 1 8 9 o W E R T Y U { o S D F G I J K > ? C V B N M pretion Status: A Moving to another question will save this response. Question 1 The firm you currently work for is looking to buy out a smaller firm and you have been given the tas cash flow of 38 million for the next 3 years and forecast that their free cash flow will grow by 5% pe Using a discounted cashflow model, what is the value of the firm? Enter your answer in millions, round Moving to another question will save this response MacBook Air 80 F3 888 14 F5 :8 @ $ 3 # & 2 A % 5 6 7 Q W E R T Y 4 S D G H you leave the test. Question 1 of 1 10 points SA and you have been given the task of estimating the value of the firm The WACC of the target company is 8.50%. The company forecast for the free how will grow by 5% per year there tem? Enter your answer in ons rounded to the room for monter Quote MacBook Air . da bill DD F : 94 912 HY A ) &7 + 6 7 00 9 O T Y U O { [ } 1 G I J K > B N M ? T e command option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts