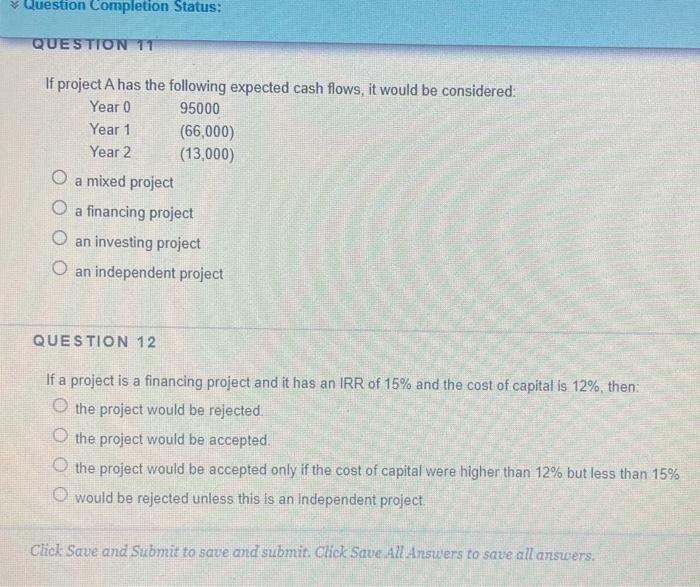

Question: Question Completion Status: QUESTION TT If project A has the following expected cash flows, it would be considered: Year 0 95000 Year 1 (66,000) Year

Question Completion Status: QUESTION TT If project A has the following expected cash flows, it would be considered: Year 0 95000 Year 1 (66,000) Year 2 (13,000) O a mixed project a financing project O an investing project O an independent project QUESTION 12 If a project is a financing project and it has an IRR of 15% and the cost of capital is 12%, then: the project would be rejected. the project would be accepted. O the project would be accepted only if the cost of capital were higher than 12% but less than 15% O would be rejected unless this is an independent project Click Save and Submit to save and submit. Click Save All Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts