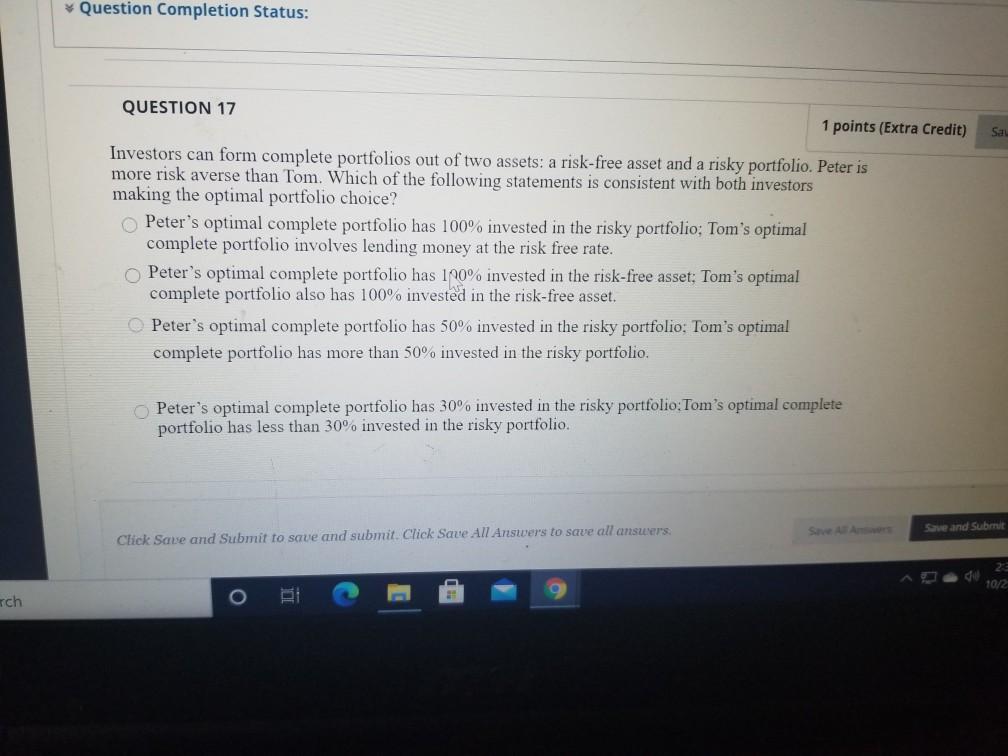

Question: Question Completion Status: Sa QUESTION 17 1 points (Extra Credit) Investors can form complete portfolios out of two assets: a risk-free asset and a risky

Question Completion Status: Sa QUESTION 17 1 points (Extra Credit) Investors can form complete portfolios out of two assets: a risk-free asset and a risky portfolio. Peter is more risk averse than Tom. Which of the following statements is consistent with both investors making the optimal portfolio choice? Peter's optimal complete portfolio has 100% invested in the risky portfolio; Tom's optimal complete portfolio involves lending money at the risk free rate. Peter's optimal complete portfolio has 100% invested in the risk-free asset: Tom's optimal complete portfolio also has 100% invested in the risk-free asset. Peter's optimal complete portfolio has 50% invested in the risky portfolio: Tom's optimal complete portfolio has more than 50% invested in the risky portfolio Peter's optimal complete portfolio has 30% invested in the risky portfolio: Tom's optimal complete portfolio has less than 30% invested in the risky portfolio Save and Submit Click Save and Submit to save and submit. Click Save All Answers to save all answers, du 10/2 rch

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts