Question: Question Completion Status Support QUESTION 12 A company's stock currently sells for $21.25 per share. The stock dividend is projected to increase at a constant

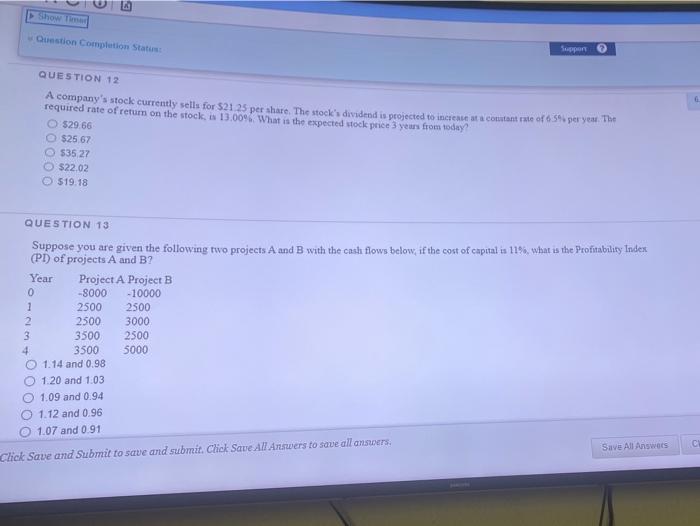

Question Completion Status Support QUESTION 12 A company's stock currently sells for $21.25 per share. The stock dividend is projected to increase at a constant rate of 6.5" per yen. The required rate of return on the stock, is 13.0096What is the expected stock price 3 years from today? $29 66 $25 67 535 27 $22.02 $19.18 QUESTION 13 Suppose you are given the following two projects A and B with the cash flows below, if the cost of capital is 11%, what is the Profitability Index (PT) of projects A and B? Year Project A Project B 0 -8000 -10000 1 2500 2500 2 2500 3000 3 3500 2500 4 3500 5000 1.14 and 0.98 1.20 and 1.03 1.09 and 0.94 1.12 and 0.96 1.07 and 0.91 Savie All Answers C Click Save and submit to save and submit. Chok Save All Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts