Question: Question: Compute the NOPLAT for 2016 with direct method. Question 1 (40 points) FCF items from income and cash flow statements(millions NOK) Sales Operating expenses

Question: Compute the NOPLAT for 2016 with direct method.

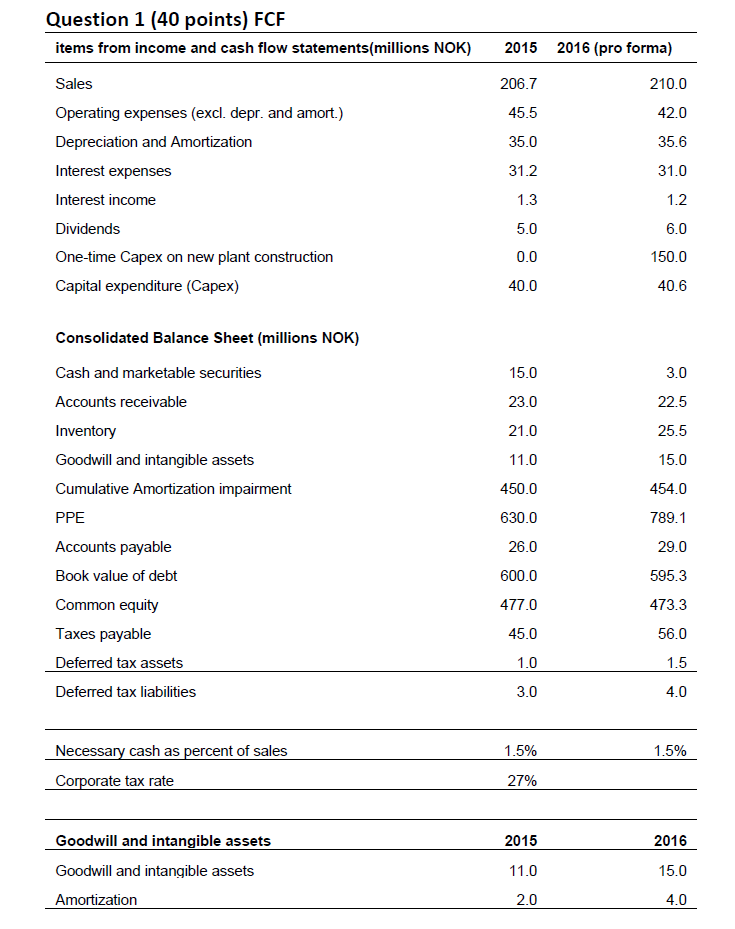

Question 1 (40 points) FCF items from income and cash flow statements(millions NOK) Sales Operating expenses (excl. depr. and amort.) Depreciation and Amortization Interest expenses Interest income Dividends One-time Capex on new plant construction Capital expenditure (Capex) 2015 206.7 45.5 35.0 31.2 1.3 5.0 0.0 40.0 2016 (pro forma) 210.0 42.0 35.6 31.0 1.2 6.0 150.0 40.6 Consolidated Balance Sheet (millions NOK) Cash and marketable securities Accounts receivable Inventory Goodwill and intangible assets Cumulative Amortization impairment PPE Accounts payable Book value of debt Common equity Taxes payable Deferred tax assets Deferred tax liabilities 15.0 23.0 21.0 11.0 450.0 630.0 26.0 600.0 477.0 45.0 3.0 22.5 25.5 15.0 454.0 789.1 29.0 595.3 473.3 56.0 1.5 4.0 3.0 Necessary cash as percent of sales 1.5% 1.5% Corporate tax rate 27% Goodwill and intangible assets Goodwill and intangible assets Amortization 2015 11.0 2.0 2016 15.0 4.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts