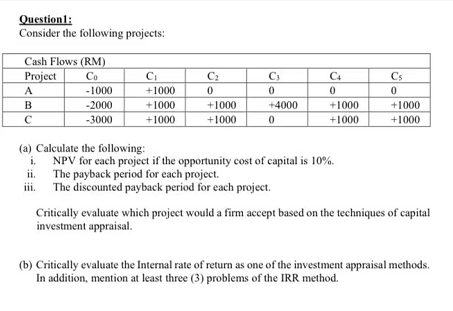

Question: Question : Consider the following projects: Cash Flows (RM) Project -1000 B -2000 -3000 C +1000 +1000 +1000 C2 0 +1000 +1000 C 0 +4000

Question : Consider the following projects: Cash Flows (RM) Project -1000 B -2000 -3000 C +1000 +1000 +1000 C2 0 +1000 +1000 C 0 +4000 0 0 CA 0 0 +1000 +1000 Cs 0 +1000 +1000 (a) Calculate the following: i. NPV for each project if the opportunity cost of capital is 10%. ii. The payback period for each project. iii. The discounted payback period for each project. Critically evaluate which project would a firm accept based on the techniques of capital investment appraisal. (b) Critically evaluate the Internal rate of return as one of the investment appraisal methods. In addition, mention at least three (3) problems of the IRR method

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock