Question: Question: Considering the four projects that we discussed earlier as well as the calculations for WACC1, WACC2 and Retained earnings breakpoint, what is the firm's

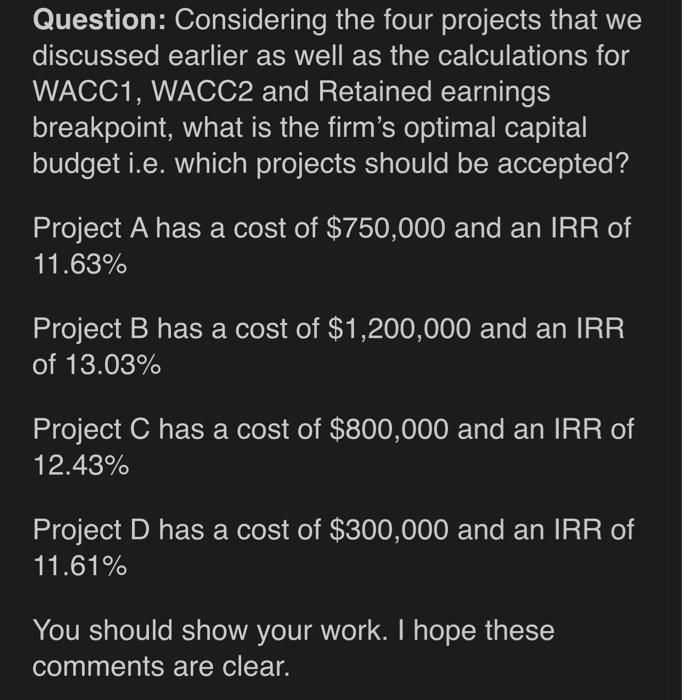

Question: Considering the four projects that we discussed earlier as well as the calculations for WACC1, WACC2 and Retained earnings breakpoint, what is the firm's optimal capital budget i.e. which projects should be accepted? Project A has a cost of $750,000 and an IRR of 11.63% Project B has a cost of $1,200,000 and an IRR of 13.03% Project C has a cost of $800,000 and an IRR of 12.43% Project D has a cost of $300,000 and an IRR of 11.61% You should show your work. I hope these comments are clear. Question: Considering the four projects that we discussed earlier as well as the calculations for WACC1, WACC2 and Retained earnings breakpoint, what is the firm's optimal capital budget i.e. which projects should be accepted? Project A has a cost of $750,000 and an IRR of 11.63% Project B has a cost of $1,200,000 and an IRR of 13.03% Project C has a cost of $800,000 and an IRR of 12.43% Project D has a cost of $300,000 and an IRR of 11.61% You should show your work. I hope these comments are clear

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts