Question: 1) Considering the four projects that we discussed and last session's calculations for WACC1, WACC2 and Retained earnings breakpoint, what is the firm's optimal capital

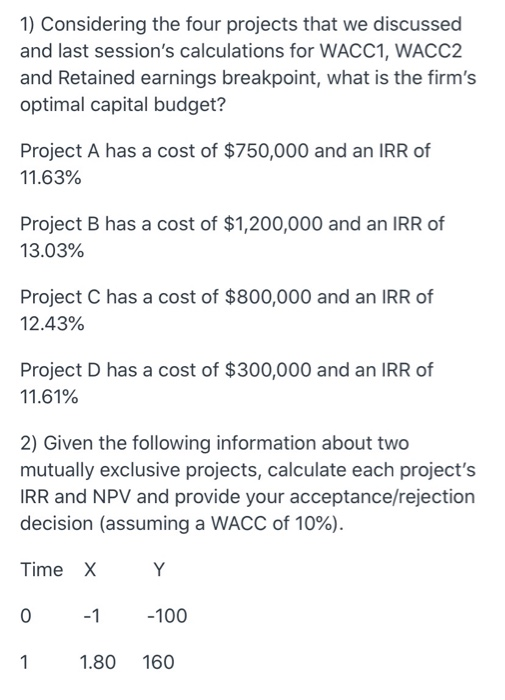

1) Considering the four projects that we discussed and last session's calculations for WACC1, WACC2 and Retained earnings breakpoint, what is the firm's optimal capital budget? Project A has a cost of $750,000 and an IRR of 11.63% Project B has a cost of $1,200,000 and an IRR of 13.03% Project C has a cost of $800,000 and an IRR of 12.43% Project D has a cost of $300,000 and an IRR of 11.61% 2) Given the following information about two mutually exclusive projects, calculate each project's IRR and NPV and provide your acceptance/rejection decision (assuming a WACC of 10%). Time X Y 0 1 -1 1.80 -100 160 1) Considering the four projects that we discussed and last session's calculations for WACC1, WACC2 and Retained earnings breakpoint, what is the firm's optimal capital budget? Project A has a cost of $750,000 and an IRR of 11.63% Project B has a cost of $1,200,000 and an IRR of 13.03% Project C has a cost of $800,000 and an IRR of 12.43% Project D has a cost of $300,000 and an IRR of 11.61% 2) Given the following information about two mutually exclusive projects, calculate each project's IRR and NPV and provide your acceptance/rejection decision (assuming a WACC of 10%). Time X Y 0 1 -1 1.80 -100 160

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts