Question: Question Content Area Continuing Payroll Problem, 4A: Chapter 4 This problem continues the process of preparing the Kipley Company's Employee Payroll Register for the pay

Question Content Area

Continuing Payroll Problem, 4A: Chapter 4

This problem continues the process of preparing the Kipley Company's Employee Payroll Register for the pay period ending January 8th, 20--. In previous chapters, gross wages were computed for each employee and using this data, FICA withholding and employer FICA liability was computed.

Requirements:

- Refer to the SIMPLE Plan Contributions and enter each employee's SIMPLE plan deduction.

- Determine and record the federal income taxes for each employee.

- Determine and record the state income taxes for each employee.

- Determine and record the city income taxes for the city of Pittsburgh.

- Total each input column.

SIMPLE Plan Contributions

A SIMPLE IRA is a retirement plan that may be established by employers, including self-employed individuals (sole proprietorships and partnerships). The SIMPLE IRA allows eligible employees to contribute part of their pretax compensation to the plan. This means the tax on the money is deferred until it is distributed.a

| KIPLEY COMPANY, INC. SIMPLE Plan Contributions | |||||||||||||

| Name | SIMPLE Deductions | ||||||||||||

| Carson, F. | $20 | ||||||||||||

| Wilson, W. | 50 | ||||||||||||

| Utley, H. | 40 | ||||||||||||

| Fife, L. | 50 | ||||||||||||

| Smith, L. | 20 | ||||||||||||

| Fay, G. | 40 | ||||||||||||

| Robey, G. | 50 | ||||||||||||

| Schork, T. | 60 | ||||||||||||

| Hardy, B. | 30 | ||||||||||||

| Kipley, C. | 80 | ||||||||||||

Employee Data

Below lists each employee's assigned Time Card No., Filing Status, and Withholding Allowances. This information is necessary when determining the amount of tax to withhold.

| Time Card No. | Employee Name | Filing Status | No. of Withholding Allowances |

|---|---|---|---|

| 11 | Fran M. Carson | S | N/A |

| 12 | William A. Wilson | S | N/A |

| 13 | Harry T. Utley | MFJ | N/A |

| 21 | Lawrence R. Fife | MFJ | N/A |

| 22 | Lucy K. Smith | S | N/A |

| 31 | Gretchen R. Fay | MFJ | N/A |

| 32 | Glenda B. Robey | MFJ | N/A |

| 33 | Thomas K. Schork | S | N/A |

| 51 | Barbara T. Hardy | MFJ | N/A |

| 99 | Carson C. Kipley | MFJ | N/A |

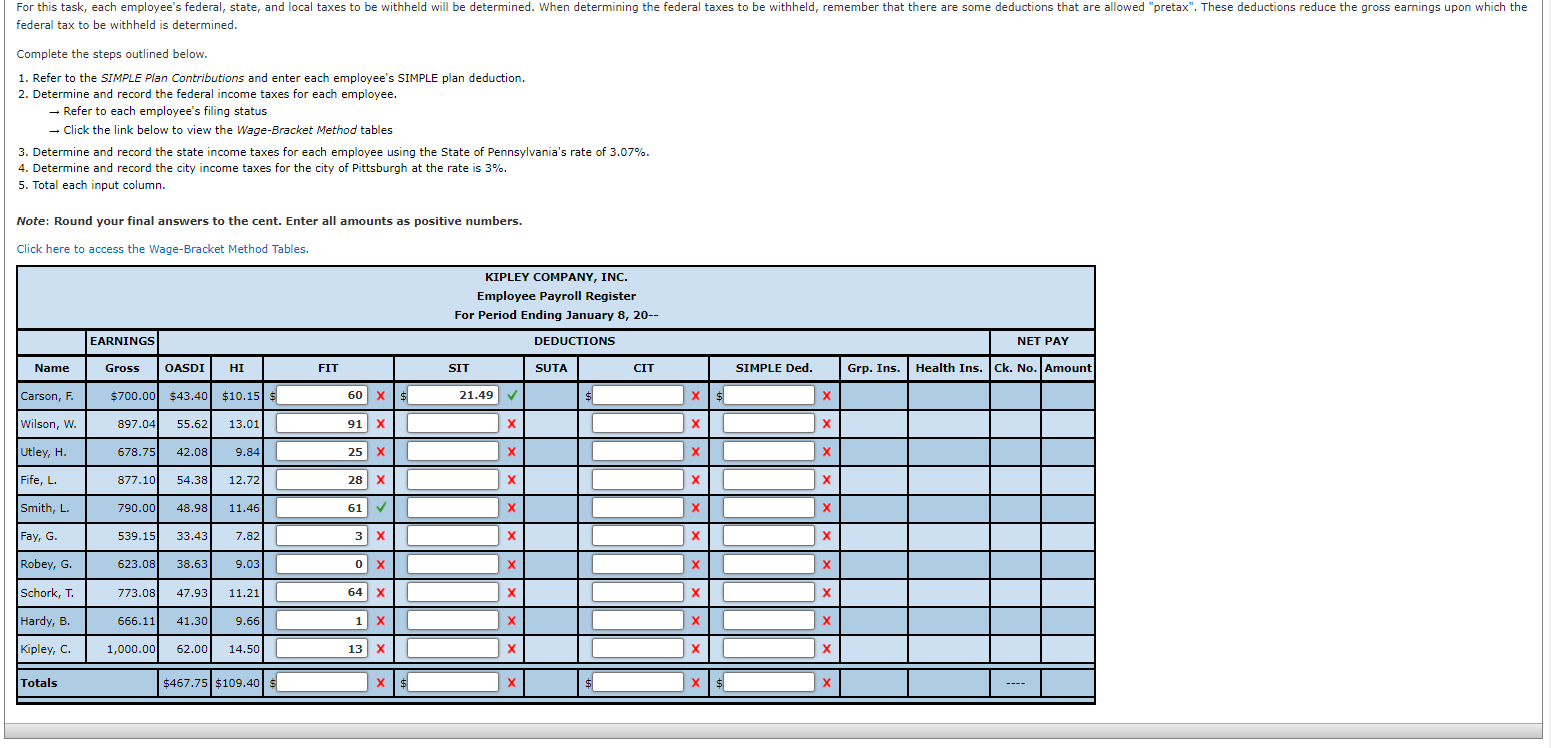

For this task, each employee's federal, state, and local taxes to be withheld will be determined. When determining the federal taxes to be withheld, remember that there are some deductions that are allowed "pretax". These deductions reduce the gross earnings upon which the federal tax to be withheld is determined. Complete the steps outlined below. 1. Refer to the SIMPLE Plan Contributions and enter each employee's SIMPLE plan deduction. 2. Determine and record the federal income taxes for each employee. Refer to each employee's filing status Click the link below to view the Wage-Bracket Method tables 3. Determine and record the state income taxes for each employee using the State of Pennsylvania's rate of 3.07%. 4. Determine and record the city income taxes for the city of Pittsburgh at the rate is 3%. 5. Total each input column. Note: Round your final answers to the cent. Enter all amounts as positive numbers. Click here to access the Wage-Bracket Method Tables. KIPLEY COMPANY, INC. Employee Payroll Register For Period Ending January 8, 20-- EARNINGS DEDUCTIONS NET PAY Name Gross OASDI HI FIT SIT SUTA CIT Grp. Ins. Health Ins. Ck. No. Amount Carson, F. $700.00 $43.40 $10.15 $ $ 897.04 55.62 13.01 Wilson, W. Utley, H. 678.75 42.08 9.84 1 877.10 12.72 1 Fife, L. Smith, L. 54.38 790.00 48.98 11.46 Fay, G. 539.15 33.43 7.82 623.08 38.63 9.03 Robey, G. Schork, T. Hardy, B. 773.08 47.93 11.21 666.11 41.30 9.66 Kipley, C. 62.00 14.50 Totals $467.75 $109.40 $ ---- 1,000.00 60 X $ 91 X 25 X 28 X 61 3 X 0 X 64 X 1 X 13 X x 21.49 X X X X X X X X X X 1 x $ |x| x X X X X x X X xs X SIMPLE Ded. X X X X X X X X X X X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts