Question: QUESTION Develop or suggest existing financial engineering innovation that can be used to properly mitigate the financial risk in the second deal. The Case XYZ

QUESTION

Develop or suggest existing financial engineering innovation that can be used to properly mitigate the financial risk in the second deal.

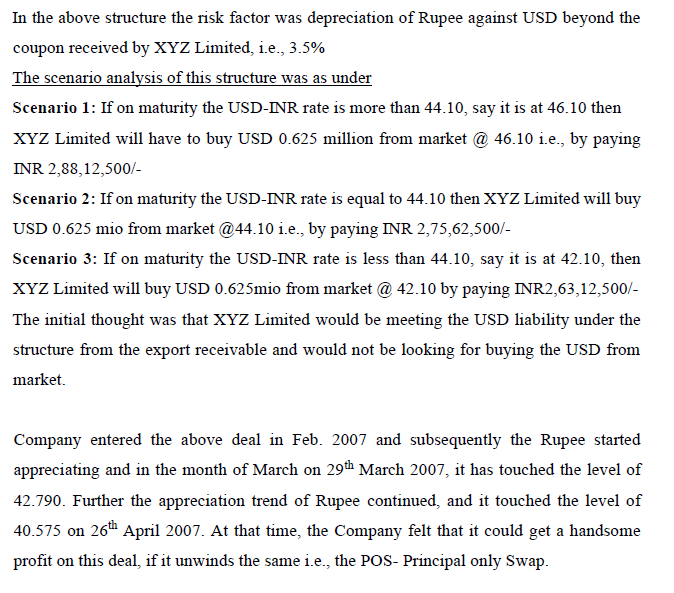

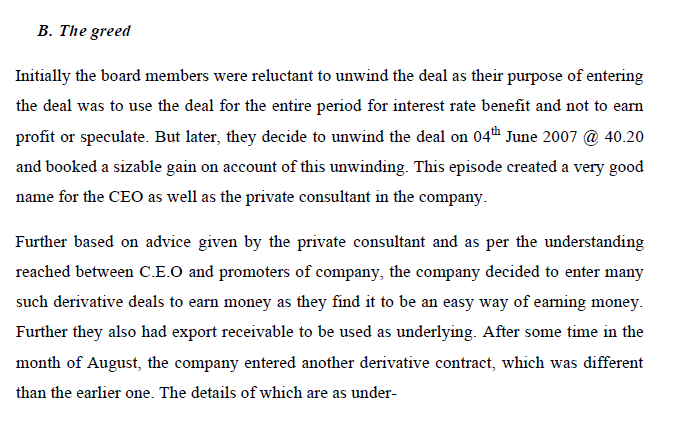

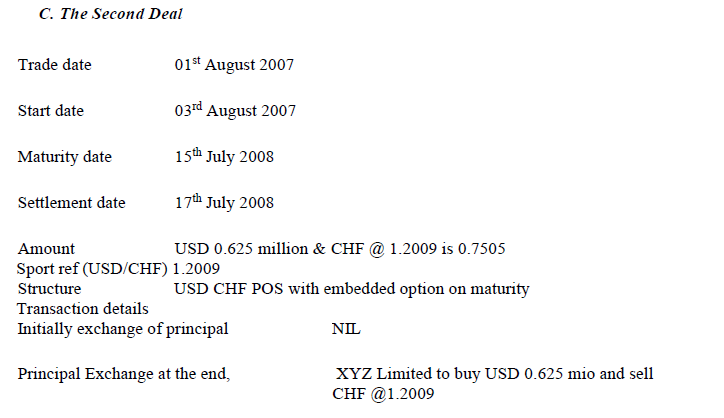

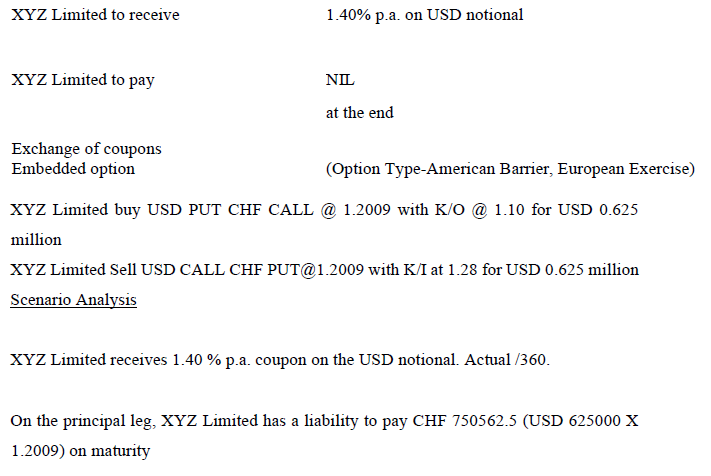

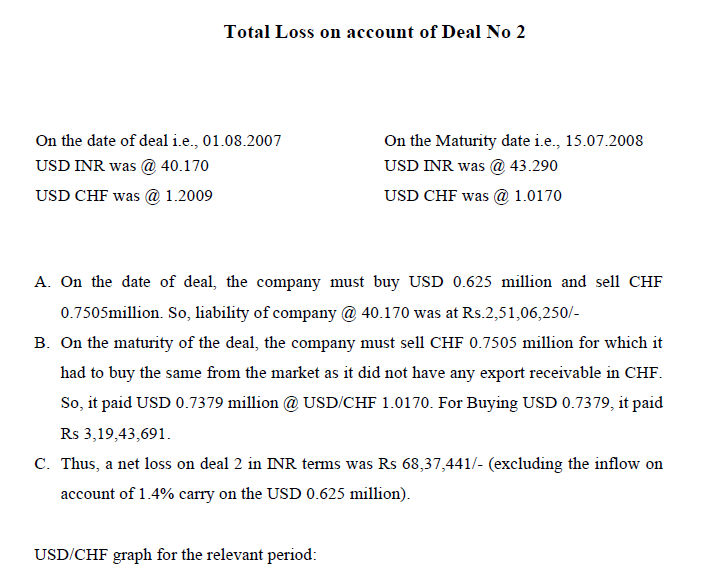

The Case XYZ Limited was a company incorporated in year 1972 as a closely held company promoted by Shri Tej along with his close relatives. The company was into manufacturing of garments. In the initial days, the company used to procure raw material from the domestic markets and selling the finished goods domestically. The margins in the business were attractive and company had shown significant improvement in the performance over the years. The depade of 80's \& 90's saw company performing very well with no major issues being faced other than some isolated events of employee unrest in the company on account of demand for hike in the wages. The management handled all these issues tactfully thus not to impact the operations significantly. After liberalization in India economy, there was a boom in cross-border trading. The company also ventured into international trade activity. They also shifted their purchase of cotton yarn from domestic markets and started importing it from China \& Pakistan on account of price differential. They also started exporting manufactured garments to western countries, particularly to United States \& European Union. Due to this change in business plan of the company, it required higher funding for its operating activity. They approached a Bank named Smart Bank Pvt Ltd for working capital facility along with Export Packing Credit, Bill Discounting \& Letter of Credit facility. The Bank found it to be an attractive proposition and went ahead with sanctioning the required facilities and secured the loan with adequate tangible collateral securities along with the primary security, which was the asset being created out of bank finance. Further the promoters strengthened the proposal by providing their personal guarantee. The unit was doing good and repaying the bank's dues on time. They were routing sales through the Cash Credit account maintained with the Bank. During the month of June 2006, the company received an order for export of USD 2.50 million worth of readymade garment to a company situated in USA. Company successfully executed that order and booked a handsome profit on the deal. Due to this deal, company was also able to establish new connection in the given geography. The board, then advised the C.E.O to approach some consultant in this regard and submit the report in the next meeting. The CEO availed the services of a private forex consultant and submitted the consultant's advisory in the next meeting. The advisory was very clear about the need for hedging for its foreign currency exposure with suitable tools, effectively. In between as the export orders were increasing, the company found that the existing production facilities were inadequate and approached the Smart Bank to sanction a Term Loan for capacity expansion. Looking to the past performance and the prospects of the company the Smart Bank was also very comfortable with the company and sanctioned a Term Loan of Rs 5 crore to be repayable in 6 years after completion of a moratorium period of 1 year. The company also agreed to serve the interest during the moratorium period. After the full disbursement of Rupee Term Loan, company C.E.O approached the bank and requested to explore the possibilities for reduction in interest rate on the term loan, as he was of the view that interest (a) 12.5\% p.a. was way too high. The Smart Bank showed its inability to reduce the interest, as the cost of borrowing for the Smart Bank was not permitting it to provide any loan below a benchmark lending rate of 10% and 2.5% was the spread as determined by the company's risk rating. With need to reduce the interest burden, the C.E.O of the company approached the consultant once again who suggested him to explore the derivative product- Rupee-Dollar Swap. Derivative is a financial instrument, whose value changes in response to the change in a specified interest rate, security price, commodity price, foreign exchange rate, index of prices or rates, a credit rating or credit index or similar variable (sometimes called the underlying) and that requires no initial net investment or little initial net investment relative to other types of contracts that have a similar response to change in market condition and that is settled at a future date. Swap is a derivative contract where two parties enter into an agreement to exchange cash flows as per agreed arrangements. So, in Rupee- Dollar Swap one party moves from Rupee liability to Dollar Liability and other party will move from Dollar Liability to Rupee liability at some agreed cost. By undertaking the Rupee-Dollar Swap the XYZ Limited was looking to convert its Rupee liability to US Dollar Liability to earn something in form of interest carry. The structure they have entered was as under: Date of Trade: 2nd February 2007 Maturity Date: 15th July 2008 Spot Reference: 44.10 INR Notional: Rs 2,75,62,500/- USD Notional: USD 0.625mio Deal Structure: 1. Initial exchange of principal: Nil 2. On maturity XYZ Limited to Pay USD 0.625 million \& Receive INR 2,75,62,500/ 3. XYZ Limited to receive interest@3.5\% per annum on the USD notional at quarterly intervals. In the above structure the risk factor was depreciation of Rupee against USD beyond the coupon received by XYZ Limited, i.e., 3.5% The scenario analysis of this structure was as under Scenario 1: If on maturity the USD-INR rate is more than 44.10, say it is at 46.10 then XYZ Limited will have to buy USD 0.625 million from market @ 46.10 i.e., by paying INR 2,88,12,500/ Scenario 2: If on maturity the USD-INR rate is equal to 44.10 then XYZ Limited will buy USD 0.625 mio from market @44.10 i.e., by paying INR 2,75,62,500/- Scenario 3: If on maturity the USD-INR rate is less than 44.10, say it is at 42.10, then XYZ Limited will buy USD 0.625 mio from market @ 42.10 by paying INR2,63,12,500/The initial thought was that XYZ Limited would be meeting the USD liability under the structure from the export receivable and would not be looking for buying the USD from market. Company entered the above deal in Feb. 2007 and subsequently the Rupee started appreciating and in the month of March on 29th March 2007, it has touched the level of 42.790. Further the appreciation trend of Rupee continued, and it touched the level of 40.575 on 26th April 2007. At that time, the Company felt that it could get a handsome profit on this deal, if it unwinds the same i.e., the POS-Principal only Swap. Initially the board members were reluctant to unwind the deal as their purpose of entering the deal was to use the deal for the entire period for interest rate benefit and not to earn profit or speculate. But later, they decide to unwind the deal on 04th June 2007@40.20 and booked a sizable gain on account of this unwinding. This episode created a very good name for the CEO as well as the private consultant in the company. Further based on advice given by the private consultant and as per the understanding reached between C.E.O and promoters of company, the company decided to enter many such derivative deals to earn money as they find it to be an easy way of earning money. Further they also had export receivable to be used as underlying. After some time in the month of August, the company entered another derivative contract, which was different than the earlier one. The details of which are as under- C. The Second Deal XYZ Limited to receive 1.40% p.a. on USD notional XYZ Limited to pay NIL at the end Embedded option (Option Type-American Barrier, European Exercise) XYZ Limited buy USD PUT CHF CALL@1.2009 with K/O@1.10 for USD 0.625 million XYZ Limited Sell USD CALL CHF PUT@1.2009 with K/I at 1.28 for USD 0.625 million Scenario Analysis XYZ Limited receives 1.40% p.a. coupon on the USD notional. Actual /360. On the principal leg, XYZ Limited has a liability to pay CHF 750562.5 (USD 625000X 1.2009) on maturity Scenario 1: 1.28 and 1.10 both levels are never seen, then XYZ Limited buys the CHF form the bank @ 1.2009 if USD/ CHF is below 1.2009 or at SPOT if USD/CHF is above 1.2009 Scenario 2: 1.28 and 1.10 both levels are seen, then XYZ Limited buys the CHF @ spot if USD/CHF is below 1.2009 or@1.2009 if USD/CHF is above 1.2009. Scenario 3: Only 1.28 is seen and 1.10 is never seen, then XYZ Limited buys the CHF form the bank@1.2009 Scenario 4: 1.28 is never seen and 1.10 is seen, then XYZ Limited buys the CHF @ spot Risk: The risk in the structure is that USD/CHF touching 1.10 levels, if that was seen, then ZYZ Limited was open to USD/CHF exchange risk on maturity The company leveraged its position and entered various structured USD/CHF deals with various authorized dealer on the same underlying, as their intention was to gain from the market movement. Subsequently on 23rd November 2007 the USD/CHF pair touched a low of 1.0896 thus triggering the 'Knock Out' leg of the embedded option structure. The second leg of the embedded option structure being 'Knock In' structure with trigger@1.28 was not triggered as the levels were never seen during the deal period. On maturity the USDCHF was @ 1.0170 and company was under obligation to Buy CHF @1.0170 against USD. The company did not have any export receivable in CHF. Further the USD purchase cost against INR had also gone up as the USD/INR rate which was @40.170 on 01st of August 2017 had also gone up due to Rupee's depreciation and was @43.290 on 15th July 2008 . Similarly in other deals also, as the CHF never touched the knock-In levels but have touched the knock-out levels, so company was open to market risk and must buy CHF from the market to meet its obligation. Further the situation had become worse as company did not have requisite underlying to deliver because of excess leveraging and had to buy USD from the market against INR and company suffered heavy losses as Rupee had also depreciated significantly. Further to add to its trouble, the company subsequently received a notice from Income tax department for re-assessment of their P\& L as company had shown the Loss from derivative as business loss thus reducing the profit for the year by that amount and eventually its Income tax liability. Income tax department was of the view that the losses was due to speculation and not a business loss and thus company was not eligible to reduce the profit by adjusting the losses on account of these transactions and was liable to pay the taxes on full amount. The above case study is based on the derivative debacle taken place during 2006-2010 in India. The companies which initially gained some benefit on account of derivative deals, entered exotic derivative structures to earn some profits without taking care of the underlying exposure, resulting in heavy financial losses due to adverse market movement of the foreign currencies. Total Loss on account of Deal No 2 A. On the date of deal, the company must buy USD 0.625 million and sell CHF 0.7505 million. So, liability of company @40.170 was at Rs.2,51,06,250/- B. On the maturity of the deal, the company must sell CHF 0.7505 million for which it had to buy the same from the market as it did not have any export receivable in CHF. So, it paid USD 0.7379 million@USD/CHF 1.0170. For Buying USD 0.7379, it paid Rs 3,19,43,691. C. Thus, a net loss on deal 2 in INR terms was Rs 68,37,441/ - (excluding the inflow on account of 1.4% carry on the USD 0.625 million). USD/CHF graph for the relevant period: USD/INR graph for relevant period The Case XYZ Limited was a company incorporated in year 1972 as a closely held company promoted by Shri Tej along with his close relatives. The company was into manufacturing of garments. In the initial days, the company used to procure raw material from the domestic markets and selling the finished goods domestically. The margins in the business were attractive and company had shown significant improvement in the performance over the years. The depade of 80's \& 90's saw company performing very well with no major issues being faced other than some isolated events of employee unrest in the company on account of demand for hike in the wages. The management handled all these issues tactfully thus not to impact the operations significantly. After liberalization in India economy, there was a boom in cross-border trading. The company also ventured into international trade activity. They also shifted their purchase of cotton yarn from domestic markets and started importing it from China \& Pakistan on account of price differential. They also started exporting manufactured garments to western countries, particularly to United States \& European Union. Due to this change in business plan of the company, it required higher funding for its operating activity. They approached a Bank named Smart Bank Pvt Ltd for working capital facility along with Export Packing Credit, Bill Discounting \& Letter of Credit facility. The Bank found it to be an attractive proposition and went ahead with sanctioning the required facilities and secured the loan with adequate tangible collateral securities along with the primary security, which was the asset being created out of bank finance. Further the promoters strengthened the proposal by providing their personal guarantee. The unit was doing good and repaying the bank's dues on time. They were routing sales through the Cash Credit account maintained with the Bank. During the month of June 2006, the company received an order for export of USD 2.50 million worth of readymade garment to a company situated in USA. Company successfully executed that order and booked a handsome profit on the deal. Due to this deal, company was also able to establish new connection in the given geography. The board, then advised the C.E.O to approach some consultant in this regard and submit the report in the next meeting. The CEO availed the services of a private forex consultant and submitted the consultant's advisory in the next meeting. The advisory was very clear about the need for hedging for its foreign currency exposure with suitable tools, effectively. In between as the export orders were increasing, the company found that the existing production facilities were inadequate and approached the Smart Bank to sanction a Term Loan for capacity expansion. Looking to the past performance and the prospects of the company the Smart Bank was also very comfortable with the company and sanctioned a Term Loan of Rs 5 crore to be repayable in 6 years after completion of a moratorium period of 1 year. The company also agreed to serve the interest during the moratorium period. After the full disbursement of Rupee Term Loan, company C.E.O approached the bank and requested to explore the possibilities for reduction in interest rate on the term loan, as he was of the view that interest (a) 12.5\% p.a. was way too high. The Smart Bank showed its inability to reduce the interest, as the cost of borrowing for the Smart Bank was not permitting it to provide any loan below a benchmark lending rate of 10% and 2.5% was the spread as determined by the company's risk rating. With need to reduce the interest burden, the C.E.O of the company approached the consultant once again who suggested him to explore the derivative product- Rupee-Dollar Swap. Derivative is a financial instrument, whose value changes in response to the change in a specified interest rate, security price, commodity price, foreign exchange rate, index of prices or rates, a credit rating or credit index or similar variable (sometimes called the underlying) and that requires no initial net investment or little initial net investment relative to other types of contracts that have a similar response to change in market condition and that is settled at a future date. Swap is a derivative contract where two parties enter into an agreement to exchange cash flows as per agreed arrangements. So, in Rupee- Dollar Swap one party moves from Rupee liability to Dollar Liability and other party will move from Dollar Liability to Rupee liability at some agreed cost. By undertaking the Rupee-Dollar Swap the XYZ Limited was looking to convert its Rupee liability to US Dollar Liability to earn something in form of interest carry. The structure they have entered was as under: Date of Trade: 2nd February 2007 Maturity Date: 15th July 2008 Spot Reference: 44.10 INR Notional: Rs 2,75,62,500/- USD Notional: USD 0.625mio Deal Structure: 1. Initial exchange of principal: Nil 2. On maturity XYZ Limited to Pay USD 0.625 million \& Receive INR 2,75,62,500/ 3. XYZ Limited to receive interest@3.5\% per annum on the USD notional at quarterly intervals. In the above structure the risk factor was depreciation of Rupee against USD beyond the coupon received by XYZ Limited, i.e., 3.5% The scenario analysis of this structure was as under Scenario 1: If on maturity the USD-INR rate is more than 44.10, say it is at 46.10 then XYZ Limited will have to buy USD 0.625 million from market @ 46.10 i.e., by paying INR 2,88,12,500/ Scenario 2: If on maturity the USD-INR rate is equal to 44.10 then XYZ Limited will buy USD 0.625 mio from market @44.10 i.e., by paying INR 2,75,62,500/- Scenario 3: If on maturity the USD-INR rate is less than 44.10, say it is at 42.10, then XYZ Limited will buy USD 0.625 mio from market @ 42.10 by paying INR2,63,12,500/The initial thought was that XYZ Limited would be meeting the USD liability under the structure from the export receivable and would not be looking for buying the USD from market. Company entered the above deal in Feb. 2007 and subsequently the Rupee started appreciating and in the month of March on 29th March 2007, it has touched the level of 42.790. Further the appreciation trend of Rupee continued, and it touched the level of 40.575 on 26th April 2007. At that time, the Company felt that it could get a handsome profit on this deal, if it unwinds the same i.e., the POS-Principal only Swap. Initially the board members were reluctant to unwind the deal as their purpose of entering the deal was to use the deal for the entire period for interest rate benefit and not to earn profit or speculate. But later, they decide to unwind the deal on 04th June 2007@40.20 and booked a sizable gain on account of this unwinding. This episode created a very good name for the CEO as well as the private consultant in the company. Further based on advice given by the private consultant and as per the understanding reached between C.E.O and promoters of company, the company decided to enter many such derivative deals to earn money as they find it to be an easy way of earning money. Further they also had export receivable to be used as underlying. After some time in the month of August, the company entered another derivative contract, which was different than the earlier one. The details of which are as under- C. The Second Deal XYZ Limited to receive 1.40% p.a. on USD notional XYZ Limited to pay NIL at the end Embedded option (Option Type-American Barrier, European Exercise) XYZ Limited buy USD PUT CHF CALL@1.2009 with K/O@1.10 for USD 0.625 million XYZ Limited Sell USD CALL CHF PUT@1.2009 with K/I at 1.28 for USD 0.625 million Scenario Analysis XYZ Limited receives 1.40% p.a. coupon on the USD notional. Actual /360. On the principal leg, XYZ Limited has a liability to pay CHF 750562.5 (USD 625000X 1.2009) on maturity Scenario 1: 1.28 and 1.10 both levels are never seen, then XYZ Limited buys the CHF form the bank @ 1.2009 if USD/ CHF is below 1.2009 or at SPOT if USD/CHF is above 1.2009 Scenario 2: 1.28 and 1.10 both levels are seen, then XYZ Limited buys the CHF @ spot if USD/CHF is below 1.2009 or@1.2009 if USD/CHF is above 1.2009. Scenario 3: Only 1.28 is seen and 1.10 is never seen, then XYZ Limited buys the CHF form the bank@1.2009 Scenario 4: 1.28 is never seen and 1.10 is seen, then XYZ Limited buys the CHF @ spot Risk: The risk in the structure is that USD/CHF touching 1.10 levels, if that was seen, then ZYZ Limited was open to USD/CHF exchange risk on maturity The company leveraged its position and entered various structured USD/CHF deals with various authorized dealer on the same underlying, as their intention was to gain from the market movement. Subsequently on 23rd November 2007 the USD/CHF pair touched a low of 1.0896 thus triggering the 'Knock Out' leg of the embedded option structure. The second leg of the embedded option structure being 'Knock In' structure with trigger@1.28 was not triggered as the levels were never seen during the deal period. On maturity the USDCHF was @ 1.0170 and company was under obligation to Buy CHF @1.0170 against USD. The company did not have any export receivable in CHF. Further the USD purchase cost against INR had also gone up as the USD/INR rate which was @40.170 on 01st of August 2017 had also gone up due to Rupee's depreciation and was @43.290 on 15th July 2008 . Similarly in other deals also, as the CHF never touched the knock-In levels but have touched the knock-out levels, so company was open to market risk and must buy CHF from the market to meet its obligation. Further the situation had become worse as company did not have requisite underlying to deliver because of excess leveraging and had to buy USD from the market against INR and company suffered heavy losses as Rupee had also depreciated significantly. Further to add to its trouble, the company subsequently received a notice from Income tax department for re-assessment of their P\& L as company had shown the Loss from derivative as business loss thus reducing the profit for the year by that amount and eventually its Income tax liability. Income tax department was of the view that the losses was due to speculation and not a business loss and thus company was not eligible to reduce the profit by adjusting the losses on account of these transactions and was liable to pay the taxes on full amount. The above case study is based on the derivative debacle taken place during 2006-2010 in India. The companies which initially gained some benefit on account of derivative deals, entered exotic derivative structures to earn some profits without taking care of the underlying exposure, resulting in heavy financial losses due to adverse market movement of the foreign currencies. Total Loss on account of Deal No 2 A. On the date of deal, the company must buy USD 0.625 million and sell CHF 0.7505 million. So, liability of company @40.170 was at Rs.2,51,06,250/- B. On the maturity of the deal, the company must sell CHF 0.7505 million for which it had to buy the same from the market as it did not have any export receivable in CHF. So, it paid USD 0.7379 million@USD/CHF 1.0170. For Buying USD 0.7379, it paid Rs 3,19,43,691. C. Thus, a net loss on deal 2 in INR terms was Rs 68,37,441/ - (excluding the inflow on account of 1.4% carry on the USD 0.625 million). USD/CHF graph for the relevant period: USD/INR graph for relevant period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts