Question: QUESTION: by using machine learning (ML) as financial engineering innovation, explain on how this ML can properly mitigate the financial risk in this case study?

QUESTION:

by using machine learning (ML) as financial engineering innovation, explain on how this ML can properly mitigate the financial risk in this case study?

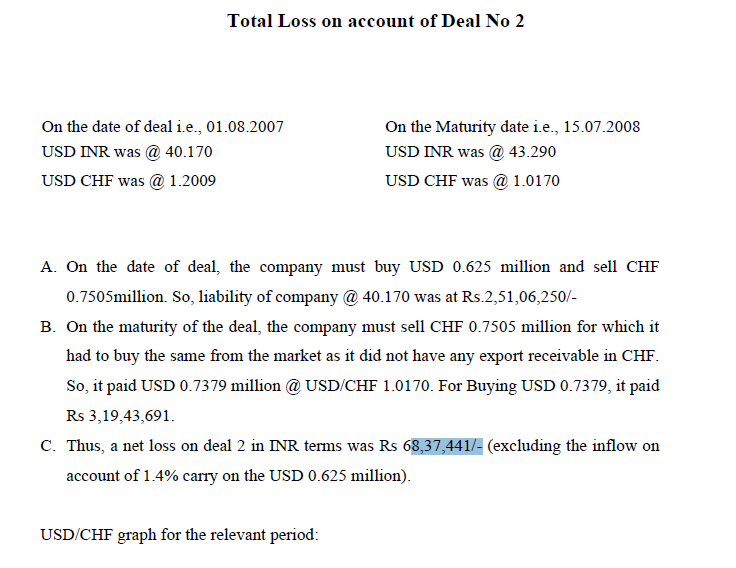

Total Loss on account of Deal No 2 A. On the date of deal, the company must buy USD 0.625 million and sell CHF 0.7505million. So, liability of company @ 40.170 was at Rs.2,51,06,250/- B. On the maturity of the deal, the company must sell CHF 0.7505 million for which it had to buy the same from the market as it did not have any export receivable in CHF. So, it paid USD 0.7379 million@ @SD/CHF 1.0170. For Buying USD 0.7379, it paid Rs 3,19,43,691. C. Thus, a net loss on deal 2 in INR terms was Rs 68,37,441/- (excluding the inflow on account of 1.4% carry on the USD 0.625 million). USD/CHF graph for the relevant period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts