Question: Question: Do think ZF Electronics are presenting their financial statements faithfully? Explain your answer. Your explanation should include illustrative accounting examples from part A and

Question: Do think ZF Electronics are presenting their financial statements faithfully? Explain your answer. Your explanation should include illustrative accounting examples from part A and secondary references, where appropriate. Word count: (800 words +/-10%)

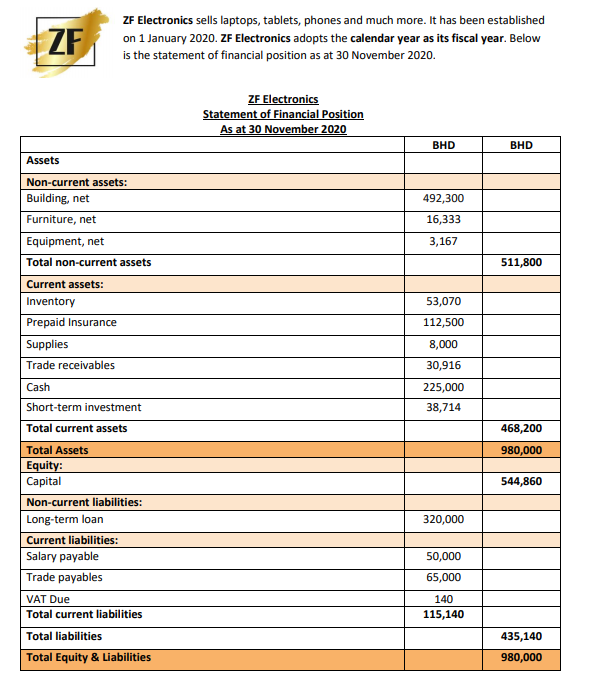

- Balance Sheet

| ZF electronics Statement of financial position As of 31st December 2020, | |||

|

| BHD | BHD |

|

| Non-current assets: |

|

|

|

| Land | 200,000 |

|

|

| Fixtures | 700 |

|

|

| Equipments | 4327 |

|

|

| Less: Accumulated depreciation-equipments | (180.5) |

|

|

| Book value equipments |

| 4146.5 |

|

| Furniture | 17,656 |

|

|

| Less: Accumulated depreciation-furniture | (355) |

|

|

| Book value furniture |

| 17,301 |

|

| Buildings | 492,300 |

|

|

| Less: Accumulated depreciation-buildings | (700) |

|

|

| Book value buildings |

| 491,600 |

|

| Total non-current assets |

| 713,747.5 |

|

| Current assets: |

|

|

|

| Accounts receivable | 33,499.8 |

|

|

| Other receivables | 3.7 |

|

|

| Supplies | 8172.5 |

|

|

| Short-term investment | 88,714 |

|

|

| Prepaid insurance | 100,000 |

|

|

| Prepaid insurance-B1 | 100,000 |

|

|

| Prepaid rent | 22,000 |

|

|

| Inventory | 56,690 |

|

|

| Cash | 171,126.5 |

|

|

| Total current assets |

| 580,206.5 |

|

| Total assets |

|

| 1,293,954 |

| Equity: |

|

|

|

| Capital |

| 654,128 |

|

| Non-current liabilities |

|

|

|

| Long-term loan | 320,000 |

|

|

| Mortgage payable | 150,000 |

|

|

| Total non-current liabilities | 470,000 |

|

|

| Current liabilities |

|

|

|

| Short-term loan payable | 50,000 |

|

|

| Salary payable | 50,000 |

|

|

| Accounts payable | 69,600.5 |

|

|

| Interest payable | 227.3 |

|

|

| Total current liabilities | 169,828 |

|

|

| Total liabilities |

| 639,828 |

|

| Total equity and liabilities |

|

| 1,293,956.8 |

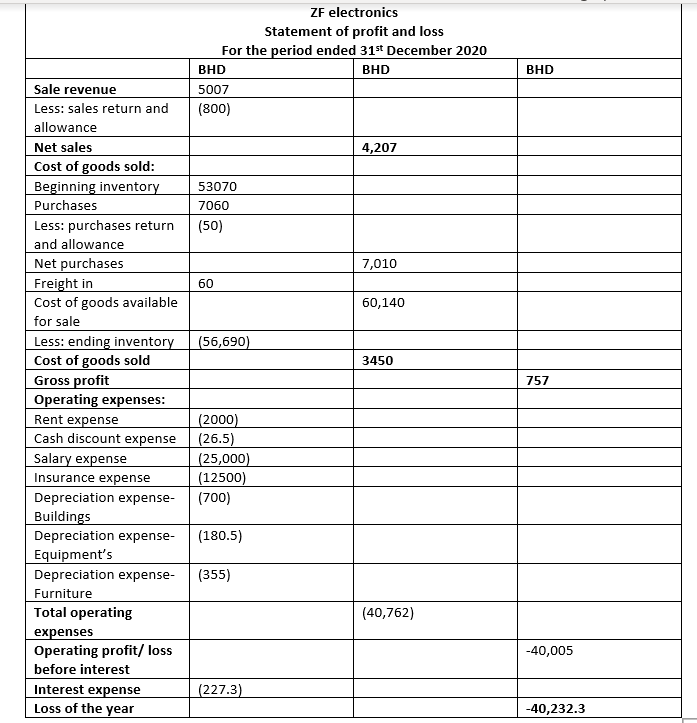

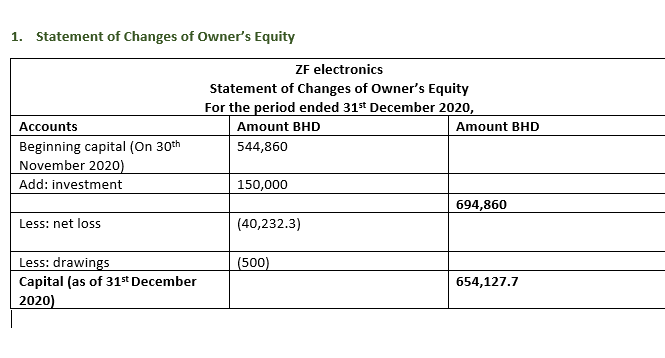

ZF electronics Statement of profit and loss For the period ended 31st December 2020 BHD BHD 5007 (800) BHD 4,207 53070 7060 (50) 7,010 60 60,140 (56,690) 3450 757 Sale revenue Less: sales return and allowance Net sales Cost of goods sold: Beginning inventory Purchases Less: purchases return and allowance Net purchases Freight in Cost of goods available for sale Less: ending inventory Cost of goods sold Gross profit Operating expenses: Rent expense Cash discount expense Salary expense Insurance expense Depreciation expense- Buildings Depreciation expense- Equipment's Depreciation expense- Furniture Total operating expenses Operating profit/ loss before interest Interest expense Loss of the year (2000) (26.5) (25,000) (12500) (700) (180.5) (355) (40,762) -40,005 (227.3) -40,232.3 1. Statement of Changes of Owner's Equity ZF electronics Statement of Changes of Owner's Equity For the period ended 31st December 2020, Amount BHD Amount BHD 544,860 Accounts Beginning capital (On 30th November 2020) Add: investment 150,000 694,860 Less: net loss (40,232.3) (500) Less: drawings Capital (as of 31st December 2020) 654,127.7 ZF ZF Electronics sells laptops, tablets, phones and much more. It has been established on 1 January 2020. ZF Electronics adopts the calendar year as its fiscal year. Below is the statement of financial position as at 30 November 2020. ZF Electronics Statement of Financial Position As at 30 November 2020 BHD BHD Assets Non-current assets: Building, net Furniture, net Equipment, net Total non-current assets 492,300 16,333 3,167 511,800 53,070 112,500 8,000 30,916 225,000 38,714 468,200 980,000 Current assets: Inventory Prepaid Insurance Supplies Trade receivables Cash Short-term investment Total current assets Total Assets Equity: Capital Non-current liabilities: Long-term loan Current liabilities: Salary payable Trade payables VAT Due Total current liabilities Total liabilities Total Equity & Liabilities 544,860 320,000 50,000 65,000 140 115,140 435,140 980,000 ZF electronics Statement of profit and loss For the period ended 31st December 2020 BHD BHD 5007 (800) BHD 4,207 53070 7060 (50) 7,010 60 60,140 (56,690) 3450 757 Sale revenue Less: sales return and allowance Net sales Cost of goods sold: Beginning inventory Purchases Less: purchases return and allowance Net purchases Freight in Cost of goods available for sale Less: ending inventory Cost of goods sold Gross profit Operating expenses: Rent expense Cash discount expense Salary expense Insurance expense Depreciation expense- Buildings Depreciation expense- Equipment's Depreciation expense- Furniture Total operating expenses Operating profit/ loss before interest Interest expense Loss of the year (2000) (26.5) (25,000) (12500) (700) (180.5) (355) (40,762) -40,005 (227.3) -40,232.3 1. Statement of Changes of Owner's Equity ZF electronics Statement of Changes of Owner's Equity For the period ended 31st December 2020, Amount BHD Amount BHD 544,860 Accounts Beginning capital (On 30th November 2020) Add: investment 150,000 694,860 Less: net loss (40,232.3) (500) Less: drawings Capital (as of 31st December 2020) 654,127.7 ZF ZF Electronics sells laptops, tablets, phones and much more. It has been established on 1 January 2020. ZF Electronics adopts the calendar year as its fiscal year. Below is the statement of financial position as at 30 November 2020. ZF Electronics Statement of Financial Position As at 30 November 2020 BHD BHD Assets Non-current assets: Building, net Furniture, net Equipment, net Total non-current assets 492,300 16,333 3,167 511,800 53,070 112,500 8,000 30,916 225,000 38,714 468,200 980,000 Current assets: Inventory Prepaid Insurance Supplies Trade receivables Cash Short-term investment Total current assets Total Assets Equity: Capital Non-current liabilities: Long-term loan Current liabilities: Salary payable Trade payables VAT Due Total current liabilities Total liabilities Total Equity & Liabilities 544,860 320,000 50,000 65,000 140 115,140 435,140 980,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts