Question: Question Doris is a web developer. His annual gross salary is $45,000. From this, he must pay social security [calculated as 10% of hik gross

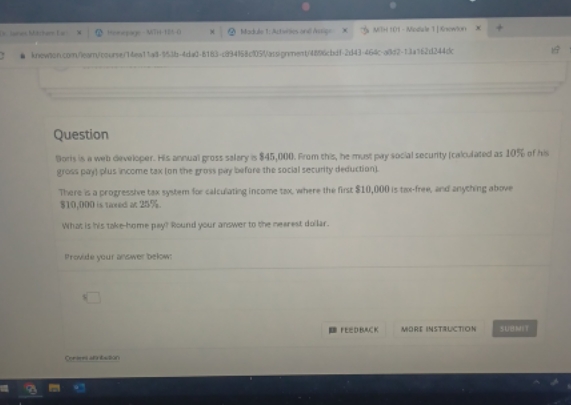

Question Doris is a web developer. His annual gross salary is $45,000. From this, he must pay social security [calculated as 10% of hik gross pay! plus income tax Ion the gross pay before the social security deduction]. There a a progressive tax system for calculating income tax where the first $10,000 is tix-free, and anything above $10,000 is based at 256. What is his take home pay? Round your answer to the rearest dollar. Provide your anewer below: I FEEDBACK MORE INSTRUCTION SUBMIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts