Question: Question Eight: Adjusting Beta for Leverage Dempsey Ltd. is a private waste management company that disposes of medical and environmental waste for other firms. Since

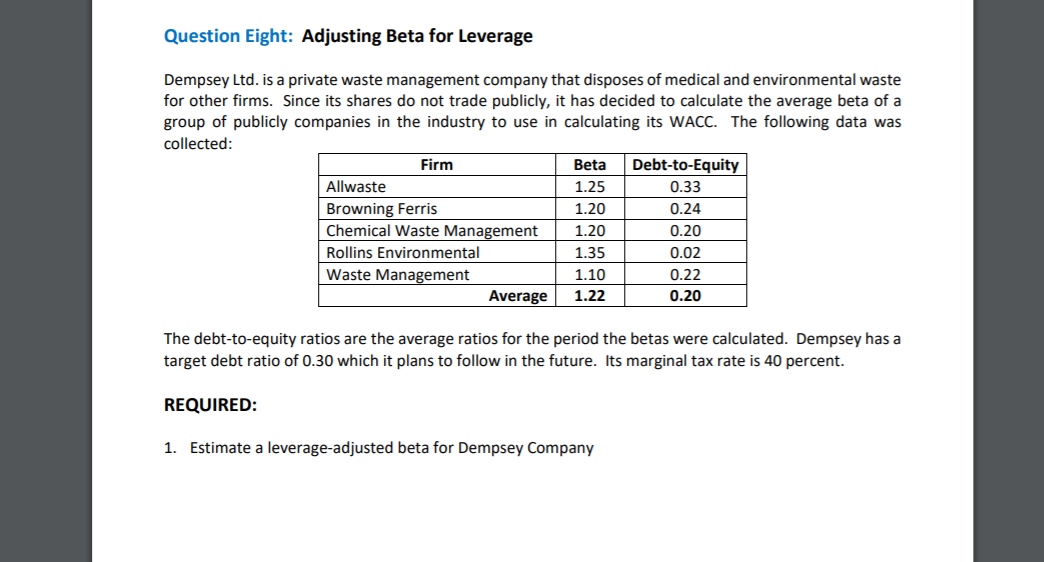

Question Eight: Adjusting Beta for Leverage Dempsey Ltd. is a private waste management company that disposes of medical and environmental waste for other firms. Since its shares do not trade publicly, it has decided to calculate the average beta of a group of publicly companies in the industry to use in calculating its WACC. The following data was collected: Firm Beta Debt-to-Equity Allwaste 1.25 0.33 Browning Ferris 1.20 0.24 Chemical Waste Management 1.20 0.20 Rollins Environmental 1.35 0.02 Waste Management 1.10 0.22 Average 1.22 0.20 The debt-to-equity ratios are the average ratios for the period the beta were calculated. Dempsey has a target debt ratio of 0.30 which it plans to follow in the future. Its marginal tax rate is 40 percent. REQUIRED: 1. Estimate a leverage-adjusted beta for Dempsey Company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts