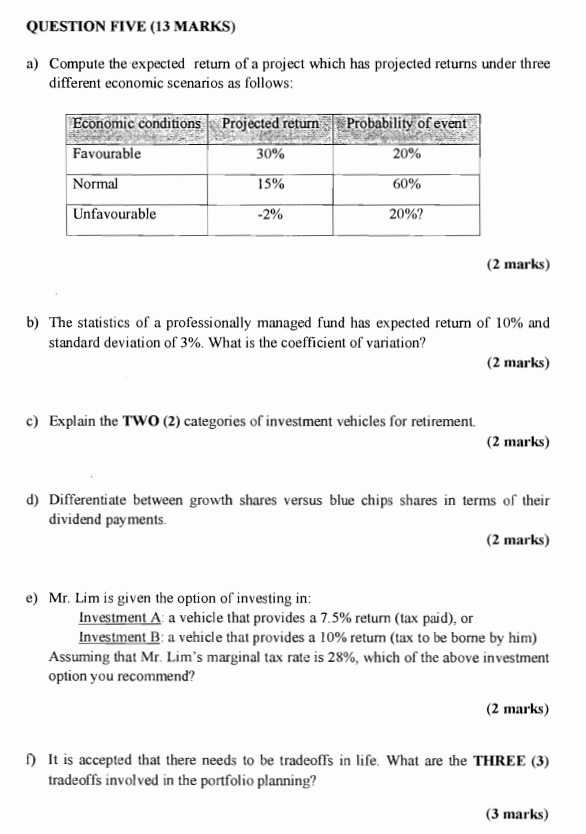

Question: QUESTION FIVE (13 MARKS) a) Compute the expected return of a project which has projected returns under three different economic scenarios as follows: b) The

QUESTION FIVE (13 MARKS) a) Compute the expected return of a project which has projected returns under three different economic scenarios as follows: b) The statistics of a professionally managed fund has expected return of 10% and standard deviation of 3%. What is the coefficient of variation? (2 marks) c) Explain the TWO (2) categories of investment vehicles for retirement. (2 marks) d) Differentiate between growth shares versus blue chips shares in terms of their dividend payments. (2 marks) e) Mr. Lim is given the option of investing in: Investment A : a vehicle that provides a 7.5% return (tax paid), or Investment B: a vehicle that provides a 10% return (tax to be borne by him) Assuming that Mr. Lim's marginal tax rate is 28%, which of the above investment option you recommend? (2 marks) f) It is accepted that there needs to be tradeoffs in life. What are the THREE (3) tradeoffs involved in the portfolio planning

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts