Question: Bob Ltd. is contemplating replacing an existing machine which was purchased 5 years ago at a cost of Sh.825,000. The machine was expected to

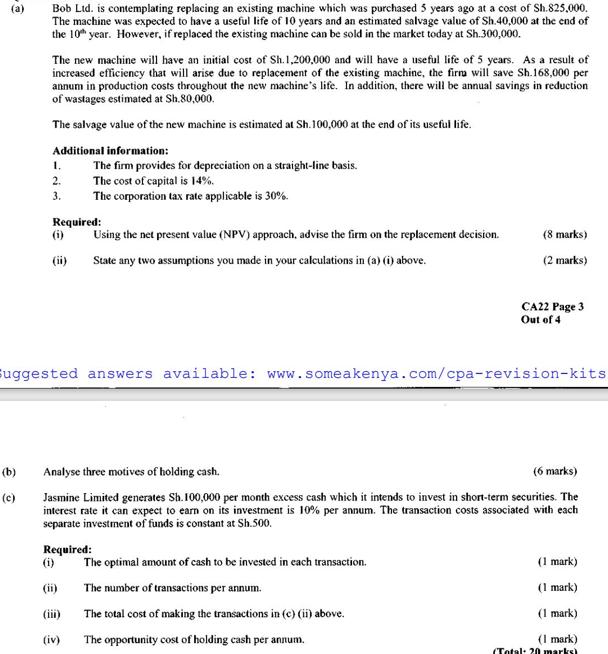

Bob Ltd. is contemplating replacing an existing machine which was purchased 5 years ago at a cost of Sh.825,000. The machine was expected to have a useful life of 10 years and an estimated salvage value of Sh.40,000 at the end of the 10th year. However, if replaced the existing machine can be sold in the market today at Sh.300,000. (b) (c) The new machine will have an initial cost of Sh.1,200,000 and will have a useful life of 5 years. As a result of increased efficiency that will arise due to replacement of the existing machine, the firra will save Sh.168,000 per annum in production costs throughout the new machine's life. In addition, there will be annual savings in reduction of wastages estimated at Sh.80,000. The salvage value of the new machine is estimated at Sh.100,000 at the end of its useful life. Additional information: 1. 2. 3. The firm provides for depreciation on a straight-line basis. The cost of capital is 14%. The corporation tax rate applicable is 30%. Required: (i) Using the net present value (NPV) approach, advise the firm on the replacement decision. State any two assumptions you made in your calculations in (a) (i) above. (iv) uggested answers available: www.someakenya.com/cpa-revision-kits (8 marks) (2 marks) CA22 Page 3 Out of 4 Analyse three motives of holding cash. (6 marks) Jasmine Limited generates Sh.100,000 per month excess cash which it intends to invest in short-term securities. The interest rate it can expect to earn on its investment is 10% per annum. The transaction costs associated with each separate investment of funds is constant at Sh.500. Required: The optimal amount of cash to be invested in each transaction. The number of transactions per annum. The total cost of making the transactions in (c) (ii) above. The opportunity cost of holding cash per annum. (1 mark) (1 mark) (1 mark) (1 mark) (Total: 20 marks)

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

STEP 1 Determine the incremental outflows pvcof Cost of new machine 1200000 Add Installation cost Working capital Less Market value of old asset 30000... View full answer

Get step-by-step solutions from verified subject matter experts