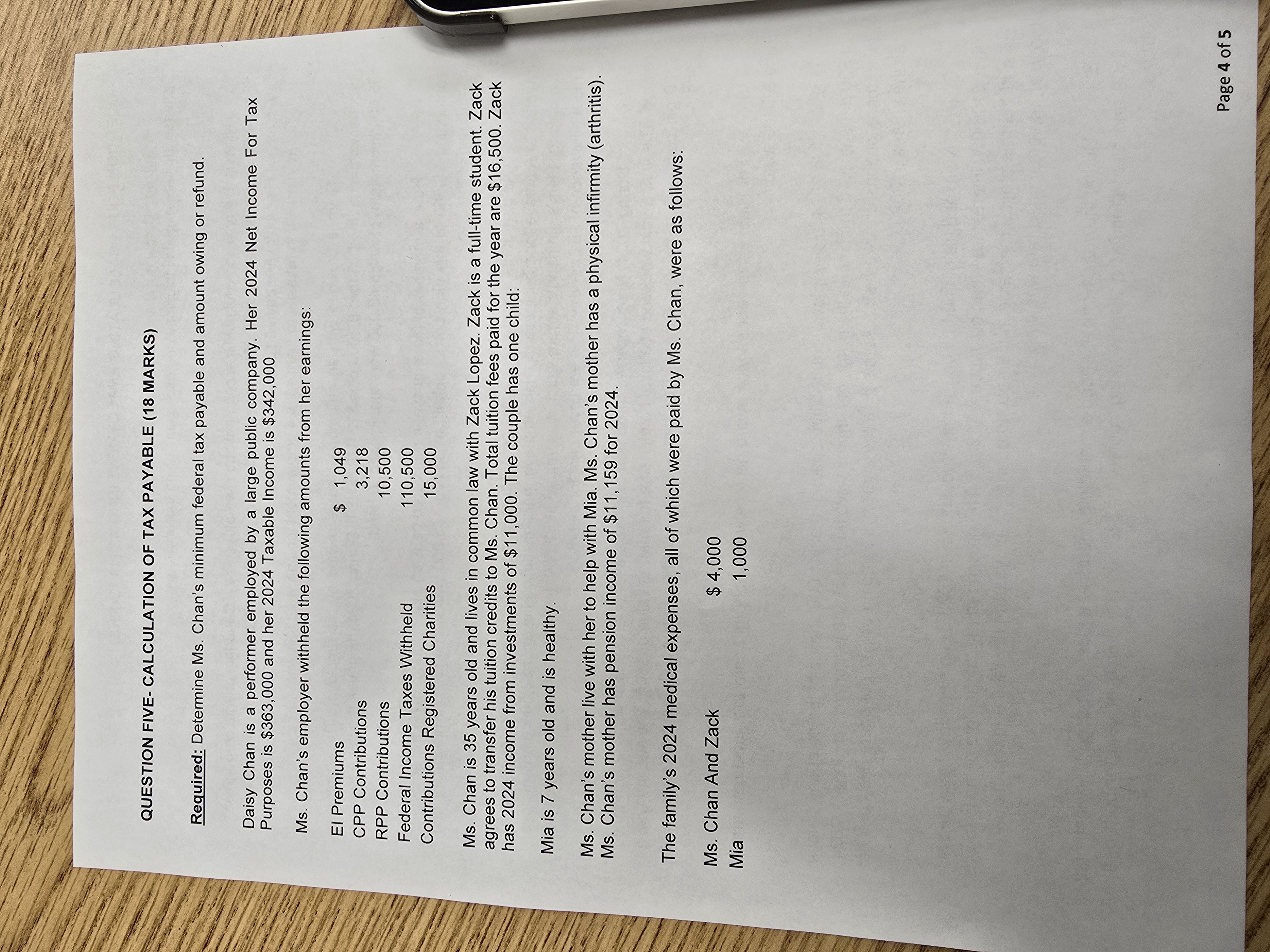

Question: QUESTION FIVE - CALCULATION O F TAX PAYABLE ( 1 8 MARKS ) Required: Determine M s . Chan's minimum federal tax payable and amount

QUESTION FIVE CALCULATION TAX PAYABLE MARKS

Required: Determine Chan's minimum federal tax payable and amount owing refund.

Daisy Chan a performer employed a large public company. Her Net Income For Tax

Purposes $ and her Taxable Income $

Chan's employer withheld the following amounts from her earnings:

Premiums

Contributions

Contributions

Federal Income Taxes Withheld

Contributions Registered Charities

$

Chan years old and lives common law with Zack Lopez. Zack a fulltime student. Zack

agrees transfer his tuition credits Chan. Total tuition fees paid for the year are $ Zack

has income from investments $ The couple has one child:

Mia years old and healthy.

Chan's mother live with her help with Mia. Chan's mother has a physical infirmity

Chan's mother has pension income $ for

The family's medical expenses, all which were paid Chan, were follows:

Chan And Zack

Mia

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock