Question: QUESTION FIVE Preston Ltd is preparing budgets for the four month period beginning 1 July 2008. It produces one product, the standard variable costs

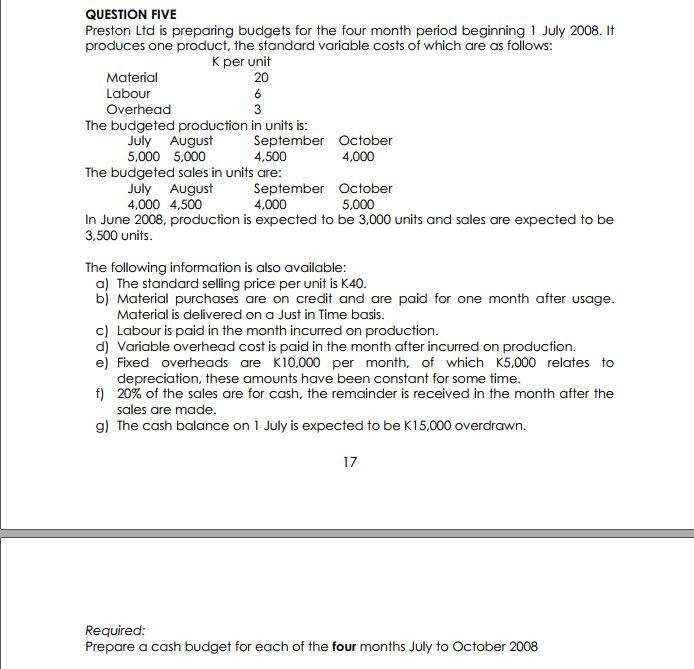

QUESTION FIVE Preston Ltd is preparing budgets for the four month period beginning 1 July 2008. It produces one product, the standard variable costs of which are as follows: K per unit Material 20 6 Labour Overhead 3 The budgeted production in units is: September July August 5,000 5,000 4,500 The budgeted sales in units are: October 4,000 July August September 4,000 4,000 4,500 In June 2008, production is expected to be 3,000 units and sales are expected to be 3,500 units. October 5,000 The following information is also available: a) The standard selling price per unit is K40. b) Material purchases are on credit and are paid for one month after usage. Material is delivered on a Just in Time basis. c) Labour is paid in the month incurred on production. d) Variable overhead cost is paid in the month after incurred on production. e) Fixed overheads are K10,000 per month, of which K5,000 relates to depreciation, these amounts have been constant for some time. f) 20% of the sales are for cash, the remainder is received in the month after the sales are made. g) The cash balance on 1 July is expected to be K15.000 overdrawn. 17 Required: Prepare a cash budget for each of the four months July to October 2008

Step by Step Solution

There are 3 Steps involved in it

Working notes Sales units Selling price per unit Total sales Cash sales Collections of prior months ... View full answer

Get step-by-step solutions from verified subject matter experts