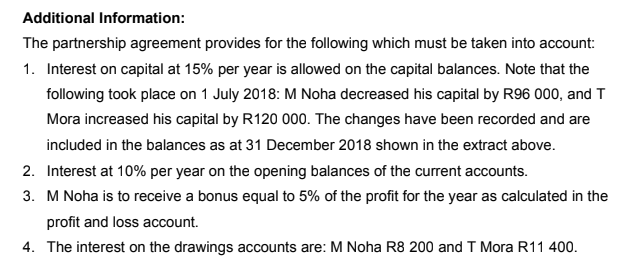

Question: QUESTION FOUR [25] The information below was extracted from the accounting records of Happy Wholesalers, a partnership with M Noha and T Mora sharing profits

![QUESTION FOUR [25] The information below was extracted from the accounting](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ea5f890e6fb_91266ea5f88a00e7.jpg)

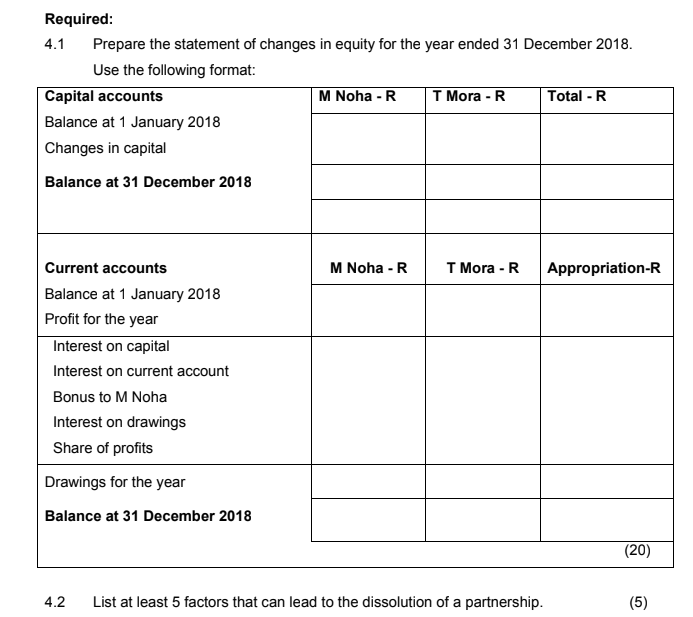

QUESTION FOUR [25] The information below was extracted from the accounting records of Happy Wholesalers, a partnership with M Noha and T Mora sharing profits and losses equally. Required: 4.1 Prepare the statement of changes in equity for the year ended 31 December 2018. 4.2 List at least 5 factors that can lead to the dissolution of a partnership. (5) Additional Information: The partnership agreement provides for the following which must be taken into account: 1. Interest on capital at 15% per year is allowed on the capital balances. Note that the following took place on 1 July 2018: M Noha decreased his capital by R96 000, and T Mora increased his capital by R120000. The changes have been recorded and are included in the balances as at 31 December 2018 shown in the extract above. 2. Interest at 10% per year on the opening balances of the current accounts. 3. M Noha is to receive a bonus equal to 5% of the profit for the year as calculated in the profit and loss account. 4. The interest on the drawings accounts are: M Noha R8 200 and T Mora R11 400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts