Question: Question Four. a) State the expected utility theorem and the characteristic of non-satiation. [4 Marks] b) A consultant, who is risk-averse and non-satiated, has been

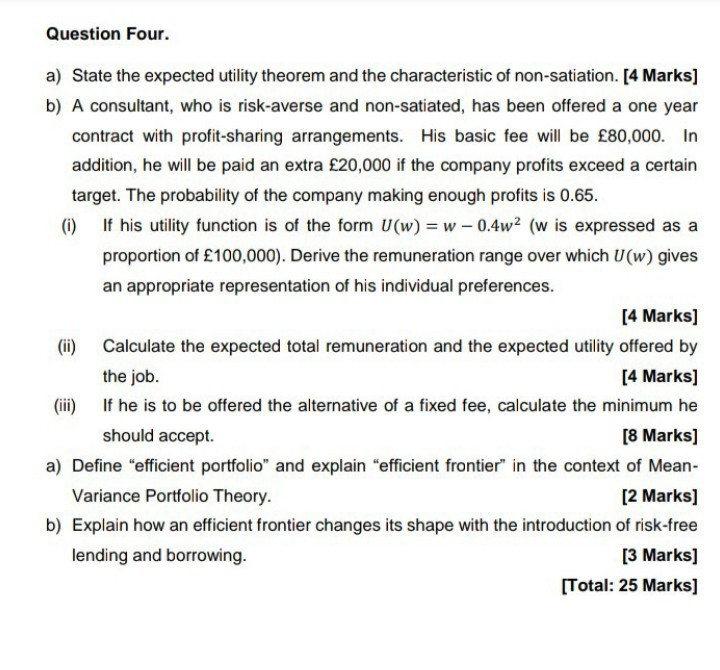

Question Four. a) State the expected utility theorem and the characteristic of non-satiation. [4 Marks] b) A consultant, who is risk-averse and non-satiated, has been offered a one year contract with profit-sharing arrangements. His basic fee will be 80,000. In addition, he will be paid an extra 20,000 if the company profits exceed a certain target. The probability of the company making enough profits is 0.65. (i) If his utility function is of the form U(w) = w -0.4w2 (w is expressed as a proportion of 100,000). Derive the remuneration range over which U(w) gives an appropriate representation of his individual preferences. [4 Marks] (ii) Calculate the expected total remuneration and the expected utility offered by the job. [4 Marks] (i) If he is to be offered the alternative of a fixed fee, calculate the minimum he should accept. [8 Marks] a) Define "efficient portfolio" and explain "efficient frontier" in the context of Mean- Variance Portfolio Theory. [2 marks] b) Explain how an efficient frontier changes its shape with the introduction of risk-free lending and borrowing. [3 Marks] [Total: 25 Marks] Question Four. a) State the expected utility theorem and the characteristic of non-satiation. [4 Marks] b) A consultant, who is risk-averse and non-satiated, has been offered a one year contract with profit-sharing arrangements. His basic fee will be 80,000. In addition, he will be paid an extra 20,000 if the company profits exceed a certain target. The probability of the company making enough profits is 0.65. (i) If his utility function is of the form U(w) = w -0.4w2 (w is expressed as a proportion of 100,000). Derive the remuneration range over which U(w) gives an appropriate representation of his individual preferences. [4 Marks] (ii) Calculate the expected total remuneration and the expected utility offered by the job. [4 Marks] (i) If he is to be offered the alternative of a fixed fee, calculate the minimum he should accept. [8 Marks] a) Define "efficient portfolio" and explain "efficient frontier" in the context of Mean- Variance Portfolio Theory. [2 marks] b) Explain how an efficient frontier changes its shape with the introduction of risk-free lending and borrowing. [3 Marks] [Total: 25 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts