Question: QUESTION FOUR - ACTIVITY BASED COSTING Charles Co makes three products for the market, the Diva (D), the Classic (C), and the Poser (P). The

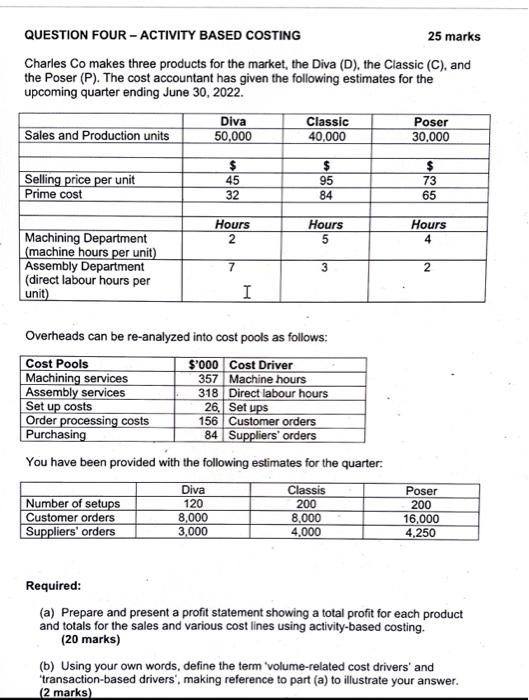

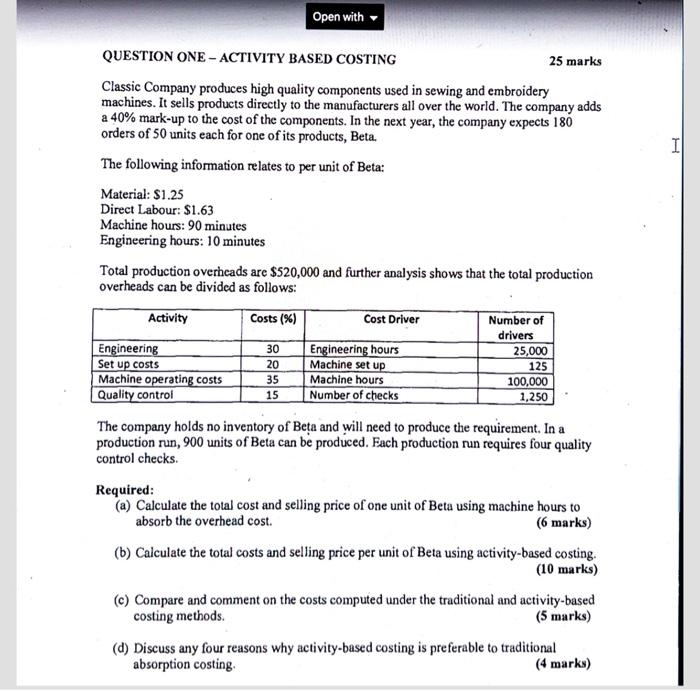

QUESTION FOUR - ACTIVITY BASED COSTING 25 marks Charles Co makes three products for the market, the Diva (D), the Classic (C), and the Poser (P). The cost accountant has given the following estimates for the upcoming quarter ending June 30, 2022. Overheads can be re-analyzed into cost pools as follows: You have been provided with the following estimates for the quarter: Required: (a) Prepare and present a profit statement showing a total profit for each product and totals for the sales and various cost lines using activity-based costing. (20 marks) (b) Using your own words, define the term 'volume-related cost drivers' and 'transaction-based drivers', making reference to part (a) to illustrate your answer. (2 marks) Classic Company produces high quality components used in sewing and embroidery machines. It sells products directly to the manufacturers all over the world. The company adds a 40% mark-up to the cost of the components. In the next year, the company expects 180 orders of 50 units each for one of its products, Beta. The following information relates to per unit of Beta: Material: $1.25 Direct Labour: $1.63 Machine hours: 90 minutes Engineering hours: 10 minutes Total production overheads are $520,000 and further analysis shows that the total production overheads can be divided as follows: The company holds no inventory of Beta and will need to produce the requirement. In a production run, 900 units of Beta can be produced. Fach production run requires four quality control checks. Required: (a) Calculate the total cost and selling price of one unit of Beta using machine hours to absorb the overhead cost. (6 marks) (b) Calculate the total costs and selling price per unit of Beta using activity-based costing. (10 marks) (c) Compare and comment on the costs computed under the traditional and activity-based costing methods. (5 marks) (d) Discuss any four reasons why activity-based costing is preferable to traditional absorption costing. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts