Question: Question Four On October 1, 2020, John Smith established an interior decorating business, Bibu Designs. During the month, John completed the following transactions related to

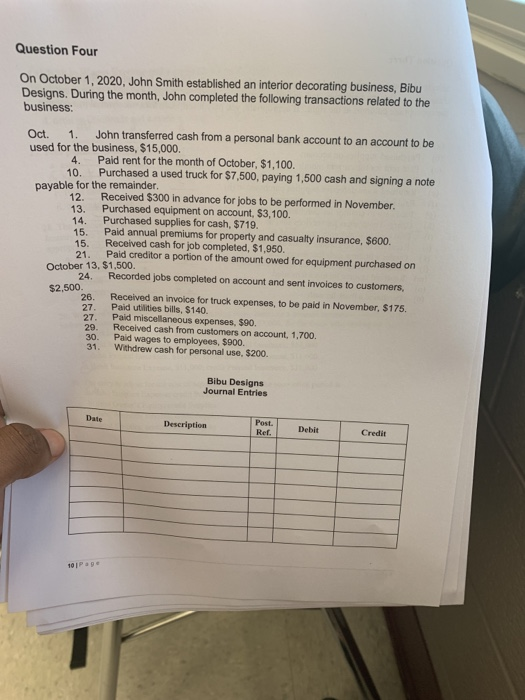

Question Four On October 1, 2020, John Smith established an interior decorating business, Bibu Designs. During the month, John completed the following transactions related to the business: Oct 1. John transferred cash from a personal bank account to an account to be used for the business, $15,000. 4. Paid rent for the month of October, $1,100. 10. Purchased a used truck for $7,500, paying 1,500 cash and signing a note payable for the remainder. 12. Received $300 in advance for jobs to be performed in November 13. Purchased equipment on account, $3,100. 14. Purchased supplies for cash, $719. 15. Paid annual premiums for property and casualty Insurance, $600. 15. Received cash for job completed, $1,950. 21. Paid creditor a portion of the amount owed for equipment purchased on October 13, $1.500. 24. Recorded jobs completed on account and sent invoices to customers, $2.500 Received an invoice for truck expenses, to be paid in November. $175. 27. Paid utilities bills. $140. 27. Paid miscellaneous expenses. $90. 29. Received cash from customers on account, 1,700 30. Paid wages to employees, $900. 31. Withdrew cash for personal use, $200 Bibu Designs Journal Entries Date Post. Description Debit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts