Question: Question Help Berkner Industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a six-year life and will cost

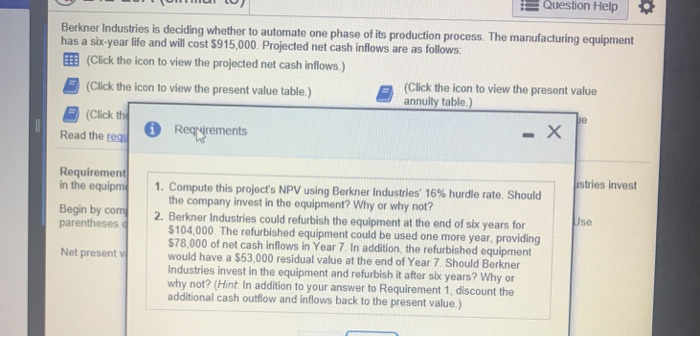

Question Help Berkner Industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a six-year life and will cost $915,000. Projected net cash inflows are as follows (Click the icon to view the projected net cash inflows ) (Click the icon to view the present value annuity table.) (Click the icon to view the present value table ) (Click th Read the rea Req irements stries invest Requirement in the equipm 1. Compute this project's NPV using Berkner industries, 16% hurdle rate. Should the company invest in the equipment? Why or why not? Begin by com 2. Berkner Industries could refurbish the equipment at the end of six years for se parentheses 104,000 The refurbished equipment could be used one more year, providing $78,000 of net cash inflows in Year 7. In addition, the refurbished equipment would have a $53,000 residual value at the end of Year 7 Should Berkner Industries invest in the equipment and refurbish it after six years? Why or why not? (Hint In addition to your answer to Requirement 1, discount the additional cash outflow and inflows back to the present value.) Net present v Question Help Berkner Industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a six-year life and will cost $915,000. Projected net cash inflows are as follows (Click the icon to view the projected net cash inflows ) (Click the icon to view the present value annuity table.) (Click the icon to view the present value table ) (Click th Read the rea Req irements stries invest Requirement in the equipm 1. Compute this project's NPV using Berkner industries, 16% hurdle rate. Should the company invest in the equipment? Why or why not? Begin by com 2. Berkner Industries could refurbish the equipment at the end of six years for se parentheses 104,000 The refurbished equipment could be used one more year, providing $78,000 of net cash inflows in Year 7. In addition, the refurbished equipment would have a $53,000 residual value at the end of Year 7 Should Berkner Industries invest in the equipment and refurbish it after six years? Why or why not? (Hint In addition to your answer to Requirement 1, discount the additional cash outflow and inflows back to the present value.) Net present v

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts