Question: Question Help Compute the Arms Index for the S&P 500 over the following 3 days: Which of the 3 days would be considered the most

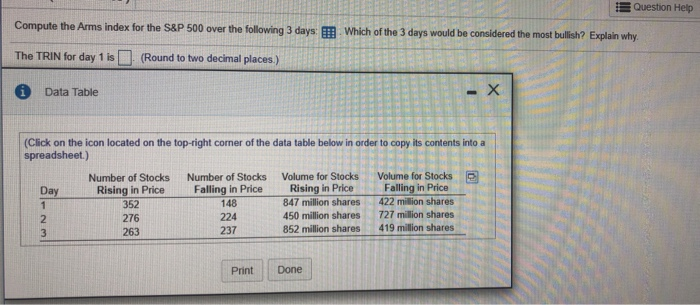

Question Help Compute the Arms Index for the S&P 500 over the following 3 days: Which of the 3 days would be considered the most bullish? Explain why. The TRIN for day 1 is (Round to two decimal places.) Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Number of Stocks Number of Stocks Volume for Stocks Volume for Stocks Rising in Price Falling In Price Rising in Price Falling in Price 352 847 million shares 422 million shares 276 224 450 million shares 727 million shares 237 852 million shares 419 million shares Day 148 Print Done

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock